In its Impacts global research programme, Savills -the international real estate advisor- examined the cost of renting a co-working arrangement relative to the net effective cost of renting a conventional prime office for a 10-person business in 16 cities around the world.

The study found that a co-working space is 40% cheaper than a traditional space, on average, although there is considerable variation between locations. Sydney, Singapore, Amsterdam and Paris have the smallest gaps between the cost of coworking space versus traditional offices, while Mumbai, Hong Kong, Los Angeles and Madrid have the cheapest coworking space relative to what a tenant could expect to pay for a traditional office in these cities.

On a purely cost basis, the lowest rents for co-working space can be found in Mumbai, Madrid, Shanghai, Amsterdam and Los Angeles, while New York and London are the most expensive, says Savills.

Competition for prime office spaces is driving up rents at the same time. Demand continues to be connected, with businesses looking for efficient, flexible, fantastically designed units in well-known locations that will attract top talent. In 2019 and 2022, premium office rents increased by an average of 4.9% across 23 global office markets.

This upward trend in rents has hit SMEs the hardest, many of which have been forced to move to more remote areas and less attractive buildings.

The alternatives

The above question is partly about how economies can protect and promote small businesses. And that's because, for start-ups, any savings made on the premises and funneled back into the business could be the difference between success and failure.

A possible solution is the promotion of collaborative business spaces, which offer full packages (all-in) without restrictive long-term leases. Given the cost of setting up and maintaining an office, these arrangements can become simpler and cheaper over time.

To compare the cost of such an arrangement, against the net real cost of a conventional office, Savills Research looked at how costs for a 10-person business varied across 16 key global markets. The study found that a co-working space is 40% cheaper on average, although there is considerable variation between locations.

When cooperative agreements prove to be too expensive, public sector funds are used alongside private investments to develop startup hubs, offering cheap rents and shared infrastructure to small-scale businesses in convenient locations. They also promote cooperation between communities, both locally and within their industrial sectors. Similarly, university incubators support ventures led by the university community.

Social housing emerges as a necessity

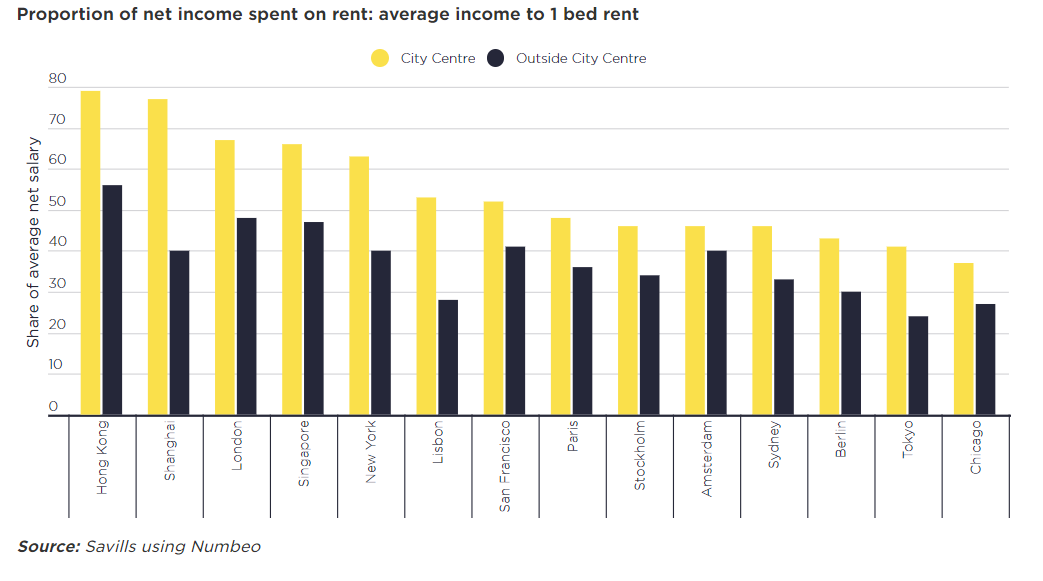

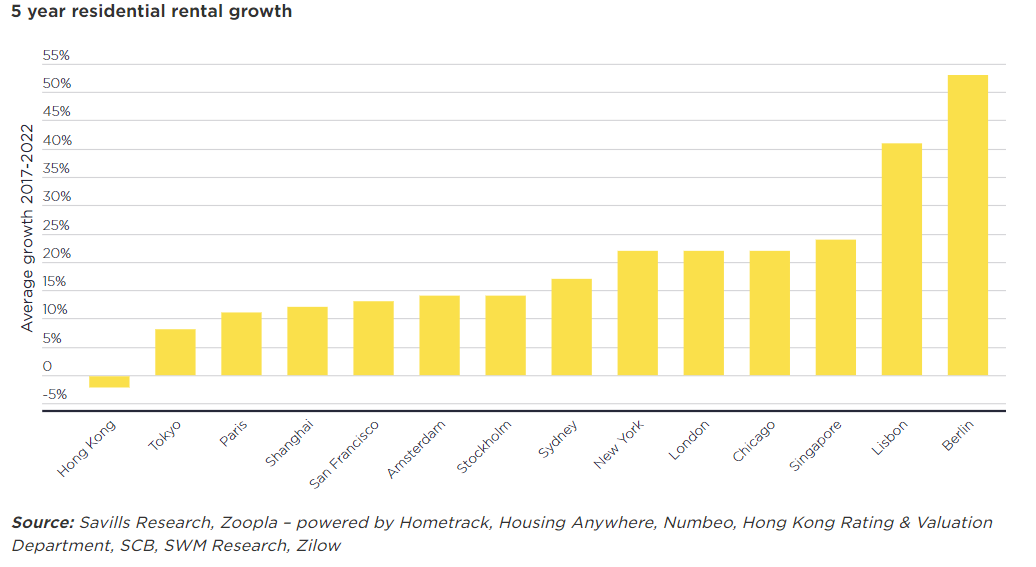

On the residential real estate front, too, affordability pressures are intense, affecting many city dwellers – especially young people, students, basic wage workers and their families.

An aging population and the rise of single households have also intensified competition for the city's limited supply of affordable housing. Both capital and rental values have increased, with demand for rental accommodation soaring driven by recent rises in mortgage rates.

Tenants are forced to look for accommodation in distant locations, stay in their home for a longer period of time, move to cheaper cities or resort to renting a room in a shared apartment.

This pressure has refocused attention on the need to provide genuinely affordable social housing, usually through some form of public sector support. In Spain and other EU countries, for example, Covid-19 recovery plans are being used to subsidize affordable housing.

Repurposing old commercial properties

Other ways to boost the availability of affordable stock in city centers comprise repurposing old commercial real estate properties for new housing, such as Les Grand Voisins, located on the former Saint Vincent de Paul Hospital in Paris. Another initiative is the revitalization of run-down neighborhoods through a combination of affordable and commercial housing along with commercial real estate.

In the UK and Europe, ESG-focused closed-end social housing funds from companies such as Man Group and Civitas bring private capital to support publicly funded social housing schemes. In this case, investors accept a lower financial return.

It is clear that there is an urgent need to redefine living and working in the inner city, in many large cities that are called upon to become more accessible, in the context of the 21st century. And in this effort, it seems that the most successful programs are those that can provide wider social and environmental benefits.

Source: Savills