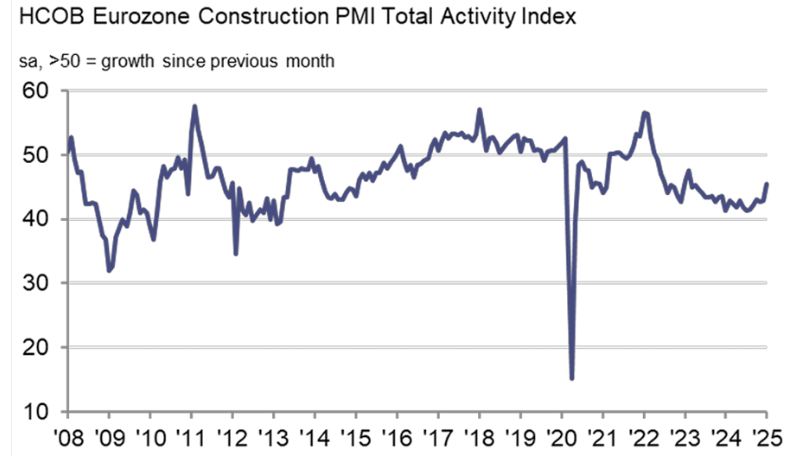

Specifically, the index stood at 44.8 points in March – slightly higher than 42.7 in February, but still well below the neutral threshold of 50 points, which indicates growth.

Although limited, this improvement allows for cautious optimism, particularly in countries like Italy, which appear to be moving in the opposite direction from the rest of the Eurozone. Nevertheless, the main engines of the European economy, such as Germany and France, continue to record significant losses, affecting the overall performance of the European construction sector.

Residential Sector: The Eurozone's "Main Patient"

The greatest burden of the crisis continues to rest on the residential sector, which has been in continuous decline in recent months. Rising borrowing costs, a general weakening of demand, and limited access to mortgage loans have led to a sharp drop in residential investments. Analysts at HCOB emphasize that, despite recent interest rate cuts by the European Central Bank, the sector has yet to show any signs of substantial recovery.

Civil engineering and commercial construction showed slightly better performance compared to February, but still failed to enter a growth trajectory. Commercial construction, in particular, recorded the mildest decline since February 2023, indicating some improvement in the business climate.

In Greece, during the first eleven months of 2024, business expectations for residential construction (according to IOBE data) showed a modest increase of 7.7% year-on-year, compared to an increase of 18.1% in 2023. Residential investments (based on ELSTAT data, in constant prices) rose by 2.7% in 2024, a stark contrast to the 24.7% growth in 2023, remaining at a low level as a percentage of GDP (2.4%).

Meanwhile, the total construction cost for new residential buildings (according to ELSTAT data) continues to rise in 2024, though at a slower annual rate (3.7%, compared to 6.2% in 2023).

Pessimism Under Partial Revision – Boost from the German Investment Package

Although the overall mood remains negative, there has been a relative retreat of pessimism among businesses. According to HCOB, the level of pessimism is the lowest in the past three years, since the onset of successive negative forecasts for the sector. Businesses in Germany, in particular, seem to be moderating their negative outlook, while in Italy, the greatest optimism in the last quarter has been recorded.

"The construction sector in the euro area remains deep in recession. While a slight recovery has occurred, the PMI index is still well below the growth threshold," stated Norman Libke, economist at HCOB. "Despite the interest rate cuts from the ECB, the sector has yet to stabilize. However, we expect a positive impact from the planned investment package by the German government, which could support construction activity towards the end of 2025."

United Kingdom: Third Consecutive Month of Decline – Historic High in Job Cuts

At the same time, the outlook in the United Kingdom is no more encouraging. The UK PMI for construction stood at 46.4 points in March, marking a decline for the third consecutive month. Although slightly improved from the historic low of 44.6 points in February, the index still indicates a clear negative trend.

Civil engineering (38.8 points) was the weakest sector, with delays in public works and uncertainty surrounding major infrastructure projects significantly burdening the outlook. The residential sector, while experiencing a milder decline, continues to be impacted by low demand and a lack of investment confidence.

More worrying is the fact that the sector experienced the fastest rate of job losses in over four years. "The lack of new projects, combined with increasing pressure on profit margins due to labor costs, has led to a freeze in hiring and the non-replacement of departing employees," said Tim Moore, director at S&P Global Market Intelligence.

The Future: What Are the Recovery Drivers?

The future of the construction sector in Europe now seems to depend on critical factors: the persistence or not of the ECB's monetary policy easing, public investment policies, and geopolitical developments that influence the investment climate. The anticipated activation of investment packages, such as Germany's, could provide the necessary boost to restart activity, especially if accompanied by measures to support housing.