More specifically, sectors related to the market outside of central Athens (e.g. grocery, household goods, DIY, discount stores and sports and outdoor equipment) have seen a significant average increase in spending in recent years compared to 2019.

Based on Savills analysis, in 2022 consumer spending on both core and non-core goods increased compared to 2021 and this positive pattern looks set to continue in 2023. "We believe that the stabilized Greek economy, followed by the income support measures by the government, will further strengthen this growth in 2024 as well, albeit at a slower pace," the company says.

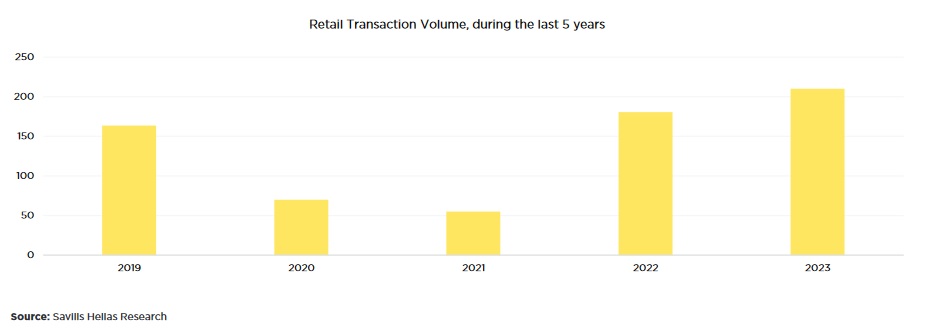

€215 million deals in retail in 2023

It is noted that during 2023 transactions have been carried out in the real estate and retail sector of the capital of approximately €215 million with the sale of the "Smart Park" (total size 52,000 sq.m.) for a total amount of €110 million "starring" giving a big boost to domestic retail investment volume.

New brands are flock centering

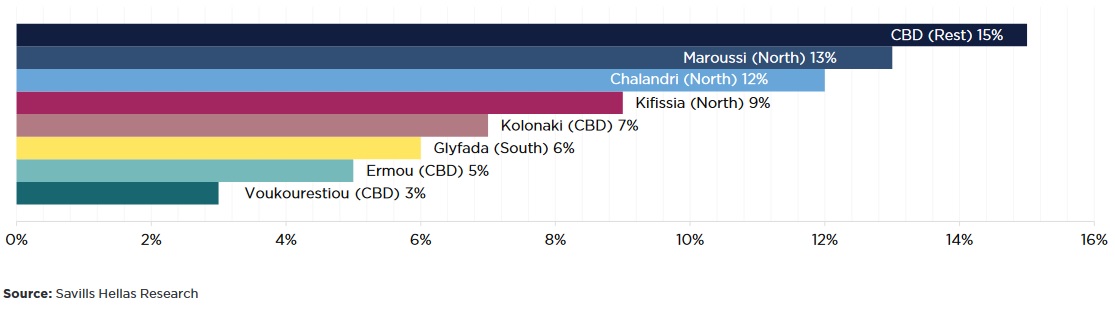

Both the center of Athens and popular streets in the Northern Suburbs seem to be regaining their lost glory after the "freeze" of the previous years brought by both the financial crisis and the Covid19 pandemic. The center of Athens is experiencing high demand from international retail brands at a time when domestic AEEAPs are proceeding with important real estate deals. According to Savills, the most important streets such as Ermou and Bucharest continue to "magnetize" leading brands such as Zara, H&M, Adidas, Hermes, Prada, Christian Dior, Chanel, Louis Vuitton, Cartier and Rolex. In addition to these two streets, the city center offers many secondary destinations and commercial "piazzas" that are mainly leased by domestic retailers, boutiques as well as F&B outlets. It is recalled that Ermou is still among the most expensive shopping streets in Europe with rental prices at over €280 per sq.m. the month.

North is picking up

The retail market of the Northern Suburbs is mainly concentrated in Marousi, Chalandri and Kifissia. The most important of these locations is Kifissia, as it attracts middle and high income consumers, with many high-end retail stores and others housed along Kolokotroni, Levidou, Panagitsa and Argyropoulou streets. The retail market of Chalandrio is mainly located in the center of the area, along L. Penteli, on Kolokotroni Street and the small pedestrian streets that connect the two areas. Chalandri offers a good mix of retail offerings with shops as well as F&B uses creating a lively location throughout the day.

High expectations for the South and the Project in Elliniko

The Southern regions of Attika gathers interest and maintains great expectations due to the Urban Redevelopment of Hellinikon. Currently, the most popular areas are Glyfada with Metaxa Street in the center and other important streets such as Vouliagmenis Avenue, Grigoriou Lambrakis and Vas Pavlou Avenue in Voula. "The development of the Hellinikon project, which among other commercial developments will offer new state-of-the-art commercial facilities arranged mainly in the two shopping centers is expected to attract consumer interest which is likely to have an impact on other retail activities," says Savills.

According to the company's reports, in all the above areas and important commercial "markets" the vacancy rates have started to decrease significantly. Top streets such as Bucharest, Ermou in the center, Kolokotroni in Kifissia and Metaxa in Glyfada are in high demand from retail groups and most of the properties that were closed due to the pandemic have already found new tenants. Urban street rent levels have risen in the post-Covid era, after lockdowns were lifted and the economy strengthened. In Kolonaki, rents for shops exceed €100/sq.m per month, in Bucharest €320 and in Glyfada €110.

Big Malls competing

The successful shopping centers of Athens continued to perform well after the lockdowns due to the pandemic with increased traffic recorded both in the second half of 2022 and throughout the financial year 2023. A trend that according to market players continues in 2024. Lamda Development - a leading company in the Malls sector - records an increase in traffic and revenues in its financial results for the first half of 2024 where the 4 Shopping Centers in operation set a new record Retail EBITDA of €43.6 million (an increase of 8% compared to of 1H 2023), mainly due to the increase in net income from basic rents (increase 7% compared to 1H 2023) and the increase in parking revenues (increase 14% compared to 1H 2023).

In fact, as recently stated by the CEO of the listed company, Odysseas Athanasiou, during the presentation of the financial results to analysts, the interest of domestic and foreign retailers in the Greek market and specifically in the ambitious project that the company is "running" in Elliniko is so high that it can proceed to change of land use of the area where the Ellinikon Mall office spaces would be built on Vouliagmenis Avenue, resulting in the leasable space increasing to 100,000 sq.m. from 90,000 sq.m. which the original plan provided for. This development will "bring" 350 stores. It is noted that according to him, to date, contracts have been signed for 63% of the retail spaces for rent, with the target for the end of 2024 being set at 70%.

However, it is worth noting that Noval Property's two shopping centers (River West and Mare West) show a correspondingly good image. The listed REIC recently completed one of the largest urban renewals in Western Attica, with the expansion of the River West Open. A hybrid proposal, which is a combination of indoor and outdoor spaces with greenery and water as dominant elements, while in the "green" spirit for its properties it completed the installation of PV panels at Mare West in Korithnos, the first commercial park certified with BREEAM In-Use.

With new stores and interventions, Trade Estates of the Fourlis group "inaugurates" the acquisition of Smart Park from REDS of the Ellactor Group. In fact, as Mr. Vassilis Fourlis recently stated in the context of the presentation of the results to analysts "Smart Park is showing very good performance in a year (2024) that will be a milestone year for REIC given that the domestic real estate market is on an upward trajectory ".

In the second half of this year, the company will proceed with the operation of the commercial park "Top Parks" in Patras with 100% occupancy, while for the new commercial park in Heraklion, it is currently at 50% in terms of construction and is estimated to open its doors in the third quarter of 2025.