This left year-on-year growth to June 2023 at 1.9%, the slowest annual growth since December 2020, at the height of the pandemic. Uncertainty surrounding current market conditions has led to caution amongst some buyers and sellers.

Rental growth outpaced capital value growth as early as December 2021 in most cities, while increases in values remain subdued, continuing the path that began last year following the onset of geopolitical turmoil in Europe and subsequent economic realities.

The lack of inventory in high-end properties has affected prices at the top end of the market, but rising interest rates mean that the transactions taking place are mostly those deemed absolutely necessary.

Limited supply of prime stock and growing demand for high-end residential product is projected to fuel price growth in European cities such as Milan, Madrid and Barcelona, where 2% to 3.9% price growth is forecast in H2.

With more and more long-term renters due to economic uncertainty, Savills expects that high-end property rents will continue to outperform capital values in the future.

Athens in possitive territory

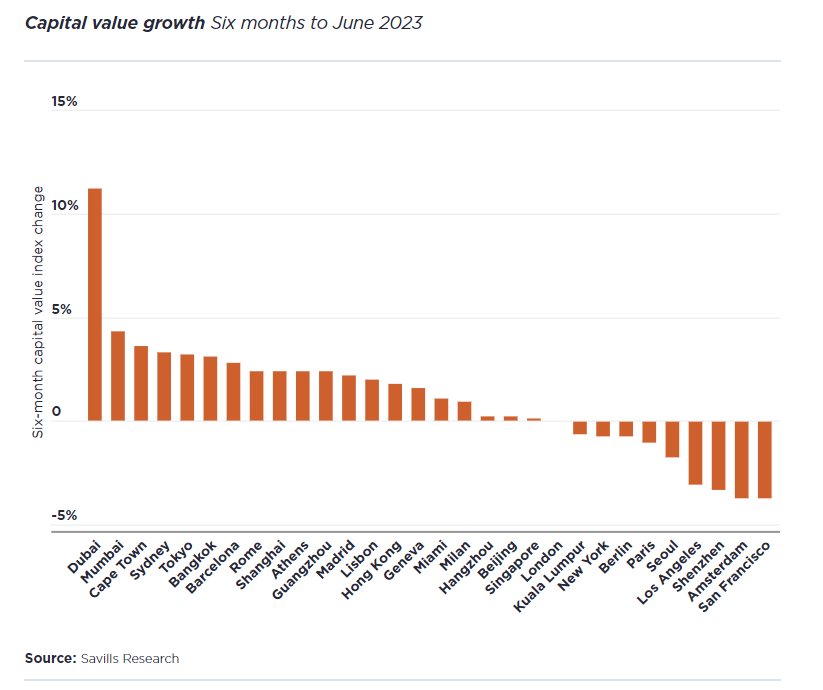

Price performance over the past six months varied across cities. Despite the economic uncertainties weighing on sentiment, Dubai is still experiencing high levels of prime residential price growth. Capital values grew by 11.2% in the first half of 2023.

Miami on the contrary– that topped last year's growth chart with 25% growth – was unable to sustain this momentum in the 1st half of 2023. However, with 1% capital value growth, it is still ahead of other cities of the US in the index.

Despite occasional declines, so far - in 2023 - global cities have overall seen capital values rise by 1.1% compared to 0.8% last year. During the first half of the year, Athens also moves with a positive sign, both in terms of capital values and rental yields.

Lisbon and Singapore’s prime residential markets, which were the top-performing cities in 2022, experienced weaker growth at the start of 2023. The majority of price growth is expected in the latter part of this year as purchasing decisions are taking longer to complete in Lisbon, and rising land and construction costs are trickling into prime pricing in Singapore.

Στο Λονδίνο, οι δήμοι με μεγαλύτερη

διεθνή ζήτηση είχαν καλύτερες επιδόσεις κατά το πρώτο εξάμηνο του έτους από

εκείνους όπου κυριαρχεί η εγχώρια ζήτηση, με αποτέλεσμα τη συνολική αύξηση των

τιμών κατά 0% το εξάμηνο έως τον Ιούνιο του 2023. Τα ίδια κεφάλαια ήταν το

κλειδί για τις συναλλαγές. Οι αγοραστές με μετρητά αντιπροσώπευαν το 71% των

συναλλαγών στο κέντρο του Λονδίνου και το 35% στα προάστια.

In London, boroughs that see more international demand performed better over the first half of the year than those where domestic demand dominates, resulting in overall price growth of 0% in the six months to June 2023. Equity was key to transactions; cash buyers have accounted for 71% of prime central London deals and 35% in outer prime London.

Other European cities, namely Paris, Berlin, and Amsterdam, have all fared worse by comparison. Buyers are less active amidst rising interest rates and a lack of high-quality stock. Best-in-class assets continue to perform well, however, creating an opportunity for new developments in this segment of the residential sector.

International demand is the key.

The best-performing cities – and areas within cities – are those with high international demand as demand from foreign buyers ensures price resilience and high yields.

Source: Savills