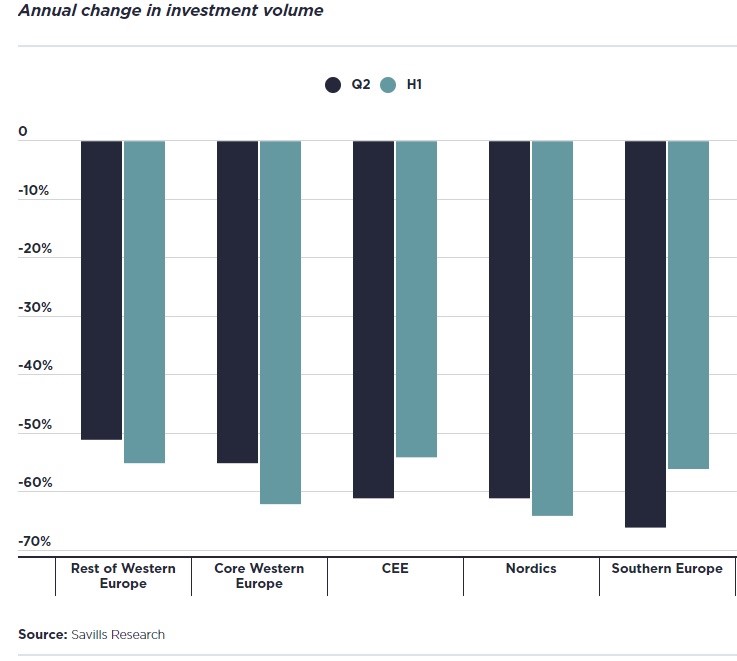

The slowdown is spread fairly evenly across Europe, with most markets reporting decreases from the European average (see chart, below). Preliminary figures suggest Southern Europe recorded the largest annual decrease in Q2 2023.

However, this is off the back of an exceptional year for investment in Southern Europe in 2022. The rest of Western Europe records the lowest drop, albeit still significantly lower than in previous years. The Nordics are likely to record the highest H1 annual drop of approximately 64%, with the expectation that this downward movement will continue into the remainder of 2023.

Over the past decade, the retail industry has experienced profound transformations due to changes in consumer behaviour, particularly the rapid surge of online sales. The resulting uncertainty in the sector has led investors to reduce their exposure to retail, according to Savills "Spotlight: European Investment – H1 2023 preliminary results".

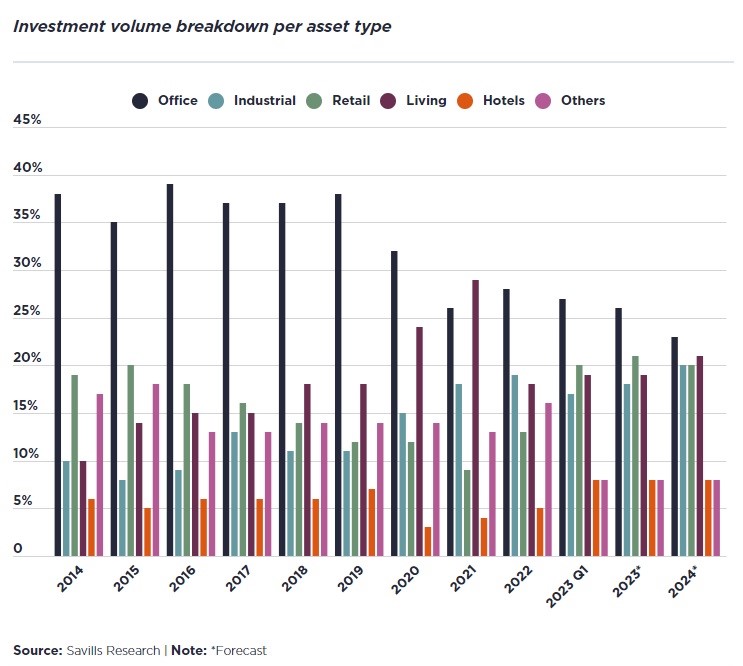

Concurrently, the escalating distribution requirements have generated increased demand for logistics warehouses, which has attracted more capital investment. As a result, the share of retail and logistics investments, which stood at 19% and 10%, respectively, in 2014, has now achieved a more balanced distribution at 20% and 17% in Q1 2023.

Going forward, Savills expect the major classes, including the living sector, offices, logistics and retail, will attract relatively similar levels of investments.

A major trend that seems to be slowly gaining traction is renewed investor interest in retail assets. In Q1 2023, retail investment recorded the slowest decline of all sectors, with €6bn transacted, accounting for 20% of total investment transactions, the highest share recorded since 2015.

According to Savills preliminary results, another €6–7bn was transacted during the second quarter of the year. This will bring the H1 result to approximately €12–13bn, with some large retail portfolios being signed in Q1 and Q2, notably the Signa AT Retail Portfolio 2023 in Austria for €400 million and the Sainsburys Reversion Supermarket Portfolio 2023 in the UK, worth €960 million. Retail has certainly fared well this year, considering the current climate. Positively, this may signal that retail, albeit limited due to the current economic landscape, may become a top pick for investors as there has been a less dramatic shift in retail values given a large proportion of the pricing correction had already taken place.

Towards a rebalancing of allocations per asset type

Over the past decade, there has been a substantial shift in investment volume across various asset classes, leading to a more evenly distributed breakdown. In 2014, European office and residential investments accounted for 38% and 10% of all sectors, respectively. However, as of Q1 2023, these figures had shifted to 27% and 19%.

This shift is notably more in line with the actual needs of society.

Considering the current European population and the workforce predominantly engaged in office-based work, we estimate that the need for residential areas is six times higher than the need for office space.

This trend also reflects the increased liquidity within each asset class in the real estate market, as well as the growing inclination towards wider portfolio diversification to mitigate potential risks.

Over the past decade, the retail industry has experienced profound transformations due to changes in consumer behaviour, particularly the rapid surge of online sales.

The resulting uncertainty in the sector has led investors to reduce their exposure to retail. Concurrently, the escalating distribution requirements have generated increased demand for logistics warehouses, which has attracted more capital investment. As a result, the share of retail and logistics investments, which stood at 19% and 10%, respectively, in 2014, has now achieved a more balanced distribution at 20% and 17% in Q1 2023.

Going forward, Savills expects the major classes, including the living sector, offices, logistics and retail, will attract relatively similar levels of investments.

Residential – the cost of rent spiralling

The surge in household mortgage rates is posing a considerable challenge to affordability which, in turn, has precipitated a notable upswing in the demand for rental properties. Furthermore, the structural supply and demand imbalance in the rental sector has been exacerbated by new regulatory legislation, particularly concerning energy ratings, which led to a striking depletion of available rental units, resulting in substantial spikes in rents. Whilst this is positive news for the financial performance of the sector, rental spiralling will certainly trigger more restrictions from local authorities. This threat, combined with low residential yields in the current market conditions, has retrained the investors’ impetus for residential units and forced prices down in spite of the solid fundamentals of the market.

The European average prime multifamily yield was at 3.9% in Q2 2023, 56 bps up on the same period last year – a relatively shallow yield expansion compared to other asset types. We anticipate a slight further increase until the end of the year, to approximately 4.0% in Q4 2023, with, however, 27% of our surveyed jurisdictions expecting prime yield to expand by more than 26 bps.

There is continued strong investor interest in purpose-built student accommodation across Europe, driven by rising total numbers of students and a strong growth in international student numbers. However, due to the lack of suitable existing stock, notably in non-core countries, the main market entry is through forward funding of new developments, which has become challenging due to the escalating cost of construction.

On average, in Europe, the prime student housing yield was at 4.4% in Q2 2023, 41 bps above the same period last year. We expect the average prime PBSA yield to be at approximately 4.6% at year-end, whilst a yield expansion above 26 bps is anticipated in 26% of the regions we cover.