According to the Sotheby's International Realty 2nd market report, viewings have increased in the first half of 2023 vs the same period last year, partly linked to the increased number of leads.

However, the growth rates between these two metrics are not congruous, contributing to a marginal decline in the Leads-to-Viewings ratio. In the H1 of 2023, the data shows a positive trend with a modest improvement in the Viewings-to-Deals ratio, reflecting enhanced conversion efficiency.

Although the current ratio is still lower than the peak achieved two years ago, it indicates progress and opportunities for growth, highlighting a journey of continuous improvement and adaptation to new standards.

Pandemic accelerated sales

In 2023, it is more evident than ever that the pandemic impacted significantly the decision patterns and rationale of HNWI during the years 2020 -2022. More specifically, decisions regarding future investments were brought forward and transactions that would otherwise be conducted in 2023 - 2025 took place way earlier.

Persistent “window shopping”

A higher-than-average rate of potential buyers remains in the exploratory phase. Although the situation has evolved positively since H1 2022, reflected by the increased Viewings to Deals ratio, the impetus to buy continues to trail the peak levels witnessed in 2020 and 2021.

Inventory shortage

The availability of unique homes, especially beachfront properties, continues to fall short of demand, a trend clearly visible amongst high-net-worth individuals. Despite forthcoming developments promising some change, it's unlikely that the overall inventory will effectively meet the demand in the near future.

Market shift with interest rate hikes

The rise in interest rates has fundamentally altered the market landscape. Concepts of financing and wealth leverage have been reframed in this new economic environment.

High asking prices

Sellers, particularly those outside renowned locales such as Corfu, the Athenian Riviera, and Mykonos, have yet to adjust their expectations. Though the market is likely to self-correct this discrepancy, prolonged listing periods can invariably lead to a decline in the final sale price.

Demand in Greece

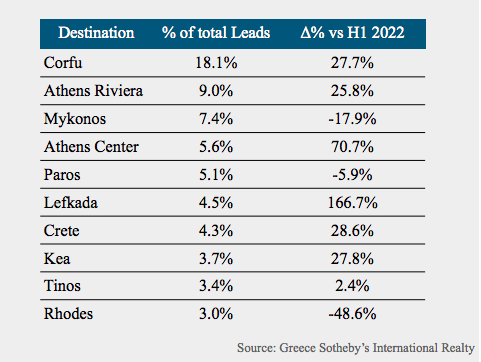

Corfu remained the top-requested destination, reflecting the island's enduring allure to luxury property seekers. The Athenian Riviera registered a significant surge in demand, outpacing the traditionally sought-after Mykonos, which marked a 17.9% decline vs the first half of 2022.

Remarkably, Athens' city center

advanced to the 4th position, surpassing several renowned island

destinations. This shift indicates a growing appeal of urban luxury

living within the vibrancy of the Greek historical capital.

The 9 Mediterranean basin markets

In most Mediterranean basin markets, the interest of High Net Worth Individuals (HNWI) in luxury housing remains stable. More specifically, offices in Italy, Greece, Cyprus, Egypt and Croatia report no change in demand pattern from 2022 to 2023. Montenegro is the only market to see an increase, while Sotheby's International Realty offices in Portugal, Spain and on the Côte d'Azur they report a decrease. On a related question about future demand for luxury homes from HNWIs, the majority of bureaus were upbeat with those in Portugal, Spain, Montenegro, Italy, Greece, Egypt and Croatia expecting an increase in buyer interest. The Cyprus and Côte d'Azur offices expect the interest pattern to remain at the same levels as in 2023.

There is an obvious interest in luxury properties from European countries. For example, Germany (DE) and the United Kingdom (UK) appear as leads in many markets, including Portugal, Spain, Greece, and Cyprus. France (FR) shows interest in Portugal, Italy and Greece. The United States (US) is showing interest in luxury homes in Portugal, Spain, Italy and Greece. The countries of Northern Europe participate in the demand in Spain, Italy and Cyprus. At the same time, the countries of Central Europe, especially the Czech Republic (CZ) and Slovakia (SK), are showing interest in the Adriatic markets: Croatia and Montenegro.

Sotheby's International Realty in Athens analysis department collaborated with Sotheby's International Realty's Cote d'Azur offices in France, Croatia, Cyprus, Italy, Spain, Montenegro, Portugal and Egypt with the aim of regionally delving into behavioral patterns of High Net Worth Individuals (HNWI). At the same time, the 2nd market report he published also includes some first quantitative data for the Greek market in the first half of 2023, where particularly useful conclusions are drawn, both for the course of sales of luxury homes so far and for the wider context of medium-term buyers horizon.