According to a report published by Catella Investment Management, despite a modest recovery in property prices, stagnant construction activity is triggering an unprecedented crisis in the rental market, raising serious concerns about housing affordability and long-term sustainability.

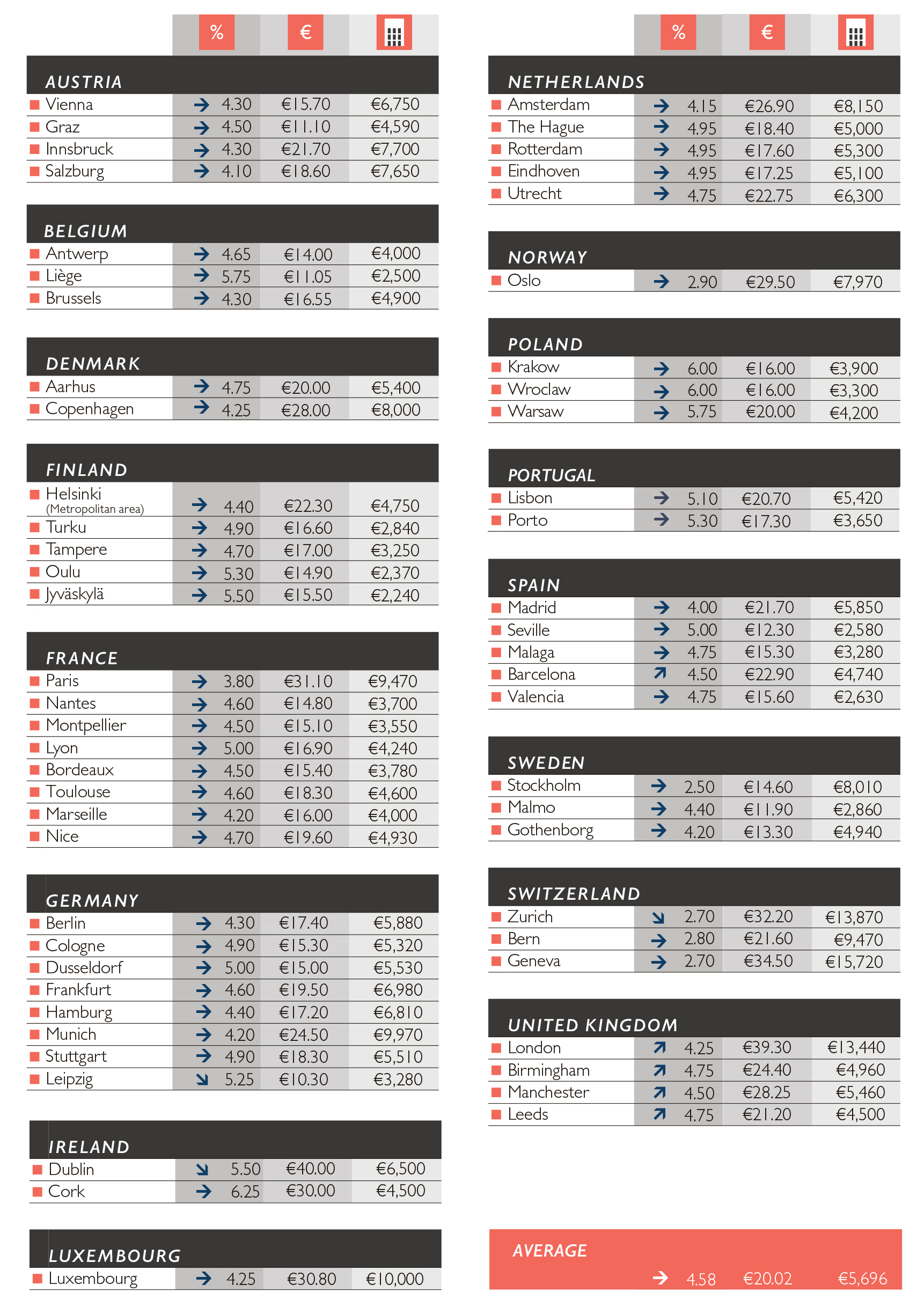

The Catella Residential Market Overview for Q1 2025 paints a bleak picture: the average rent across Europe has now reached €20.02 per square meter per month.

More specifically, Dublin continues to top the list at €40.00/m², followed by London (€39.30) and Geneva (€34.50). In contrast, the most affordable markets remain in Central and Eastern Europe, including Leipzig (€10.30), Liège (€11.05), and Graz (€11.10).

While residential property prices rose in 31 cities, with the unweighted average now at €5,696/m² (a 0.9% increase from Q3 2024), yield stagnation has become a growing concern for investors.

Prime residential yields remain stable at 4.58%.

Ultra-low yields in cities like Stockholm (2.50%) and Zurich (2.70%) signal continued institutional investor interest, while markets such as Cork (6.25%) and Krakow (6.00%) offer alternative opportunities for yield-driven investors.