Although the reduction of environmental impact is in itself a significant reason for the development of sustainable buildings, research reveals that sustainability also plays a key role in shaping resident satisfaction and long-term retention.

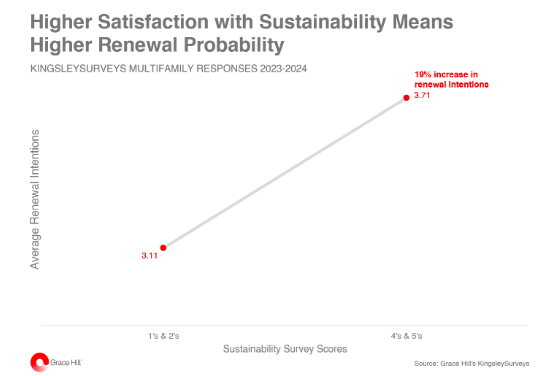

Compared to residents of non-certified properties, those living in sustainably certified buildings exhibit higher retention rates. Specifically, green homes have a resident retention rate that is 6% higher than other properties.

The retention of residents pertains not only to the economic benefits for investors but also to the stability of a community. Long-term residents enhance neighborhood cohesion, foster stronger social bonds, and promote a higher quality of life.

The evolving landscape underscores that sustainability is not merely an environmental or legal obligation, but a critical factor that influences the dynamics of the real estate market. Investors and property managers who integrate green practices not only reduce environmental impact but also improve the financial performance of their properties, ensuring higher resident retention rates and creating more stable and attractive communities.

As sustainable practices continue to gain traction, green communities represent the future of real estate, offering a competitive edge for both investors and residents.

GRESB collaborates closely with investors, asset managers, and real estate companies to advance sustainability strategies that not only enhance energy efficiency but also strengthen resident retention, contributing to more resilient and long-term profitable property portfolios.

Founded in 2009, GRESB provides investors and real estate managers with a framework for measuring, benchmarking, and reporting on their sustainability performance. Today, it represents approximately 2,223 real estate companies, collectively managing nearly $9 trillion in gross asset value.

source: GRESB