In the nine-month period of 2023, the Group's Turnover amounted to €269.8 mil. while the Turnover in the corresponding period of previous year had settled at €316.1 mil., mainly due to the significant decrease of average sale prices (in the first months of 2022, raw material prices increased at historically high levels and therefore sale prices had also settled at higher levels), and also due to the relatively limited decline in volumes by 1.6%, as a result of the low demand in the main sectors of the economy (e.g. construction, agricultural sector) primarily in the European Union, United Kingdom and USA.

During the first 9months of 2023, EBITDA amounted to 37.0 mil. During the nine-month period of 2022, EBITDA had amounted to €42.6 mil., however after deducting the extraordinary profit from the sales of COVID-19 products (of approximately €5.3 mil.), in directly comparable terms, EBITDA of the nine-month period of 2022 amounted to €37.3 mil. Therefore in comparable terms, EBITDA for the 9months period of 2023 decreased by 0.7% due to the lower demand.

In particular, during the third quarter of the year, Turnover amounted to €89.7 mil. compared to €103.4 mil. in the third quarter of 2022, entirely due to lower average sale prices resulting from the lower raw material prices and limited demand, however in terms of volumes, the Group managed to attain an increase by 6.9% compared to the third quarter of 2022. In terms of operating profitability, EBITDA of the third quarter amounted to €13.0 mil., increased by 7.7% compared to the adjusted EBITDA of €12.0 mil. of the third quarter of 2022 (i.e. after deducting the profit from the sales of COVID-19 products of €0.6 mil.).

Regarding the liquidity levels of the Group and the trading cycle of the subsidiaries, the Group's Net Debt amounted to €19.4 mil. compared to €21.5 mil. at the end of the previous year, indicating that during the period, the Group’s financial position was even further improved. Also, the calculation of Net Debt does not include a nine-month time deposit of €3.5 mil., therefore, in case the specific amount had been included, the Group's net debt would amount to €15.9 mil.

The Bord of Directors decided the distribution of an interim dividend for the fiscal year 2023, of a total amount of €3 mil. (gross amount). The distribution of the interim dividend will commence on December 6th, 2023.

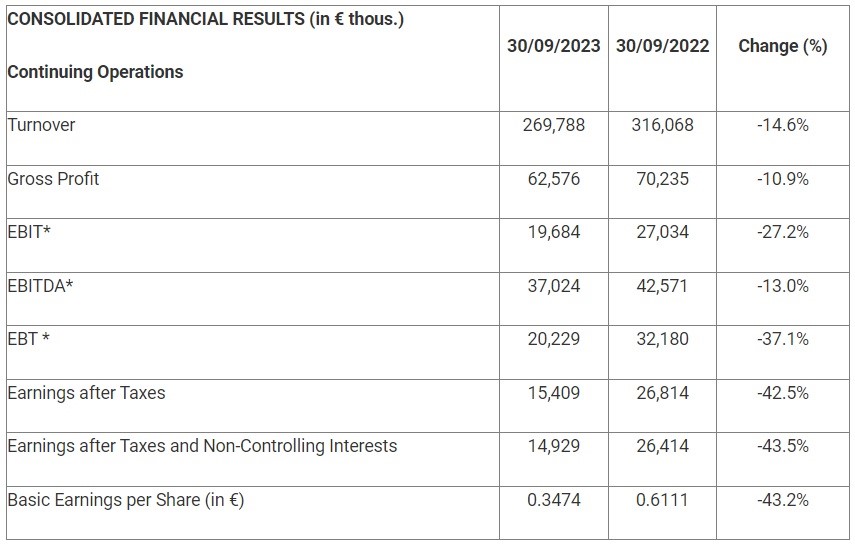

More specifically, the following table depicts the key financial figures from continuing operations of the Group during the nine-month period of 2023 compared to the corresponding period of 2022:

Prospects of the Group

With regard to the last quarter of the year, the Group's Management closely monitors and continues to adapt to the changes taking place on the macro-economic level, making at the same time strong efforts to achieve the best possible financial performance, despite the deterioration of the geopolitical backdrop in Middle East. Although the Group does not expect any direct impact in terms of sales in that region, the broader uncertainty of macroeconomic conditions may affect both the markets and the economies in which the Group activates.

However, regarding the Group's annual profitability, the Management estimates that although demand in several product categories remains subdued and uncertainty flares up amid the new geopolitical crisis, the current year's profitability in terms of EBITDA is expected to fluctuate alongside the respective levels of 2022 (it is noted that the extraordinary profit of €5.3 mil. due to COVID-19 should be deducted from FY2022 EBITDA). This demonstrates the ability of the Group amid intense and adverse conditions to remain focused and capable of achieving its goals.