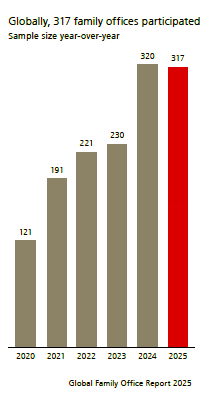

The escalating global trade war has emerged as the primary concern for 2025 among the world’s wealthiest families, according to the UBS Global Family Office Report 2025. The annual report draws on responses from 317 family offices, each overseeing an average of $1.1 billion in assets.

The survey, conducted between January 22 and April 4, 2025, found that 70% of respondents identified threats to their financial objectives over the next 12 months as a key worry—chief among them, the trade war. The second most cited concern, reported by 52% of participants, was the risk of a major geopolitical conflict, followed closely by persistent inflation.

Looking further ahead, over a five-year horizon, concerns around geopolitical tensions increase significantly, with 61% of family offices anticipating a major conflict. Additionally, 53% expressed fears of a potential global recession—likely driven by intensifying trade disputes. Half of the respondents also voiced concerns about a sovereign debt crisis, underlining widespread awareness of growing fiscal vulnerabilities.

Despite heightened uncertainty, a majority of family offices (59%) are not planning to reduce investment risk. Instead, they are focused on maintaining long-term resilience through strategic diversification.

UBS highlights the following key adjustments in portfolio strategies:

- 40% are enhancing diversification by turning to specialized investment managers

- 31% are increasing allocations to hedge funds

- 26% are investing in high-quality, short-duration fixed income instruments

- 19% are allocating to precious metals—primarily gold—with this figure expected to rise to 21% within five years

“In an era marked by rising volatility, fears of a global downturn, and an almost unprecedented market sell-off in early April, our latest report underscores that family offices remain anchored to long-term, disciplined strategies focused on wealth preservation across generations,” said Benjamin Cavalli, Head of Strategic Clients at UBS Global Wealth Management.

“Even though much of the research was conducted during the first quarter, family offices were already acutely aware of the risks posed by a global trade war—identifying it as the single greatest threat for the year. In follow-up interviews held after the market turbulence in early April, they reiterated their commitment to diversified, all-weather asset allocation strategies,” he added.

Investments in the U.S. and Europe

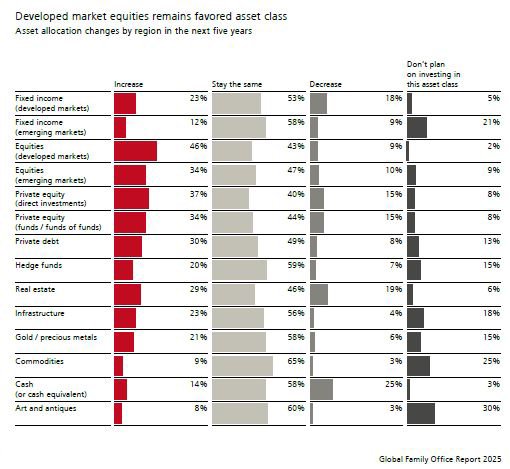

According to the UBS report, developed markets—particularly the United States and Europe—continue to be viewed as the safest investment destinations by family office managers. Equity allocations to these regions rose to 26% in 2024 and are projected to reach 29% by the end of the current year. Furthermore, 46% of investors plan to increase their exposure to developed markets over the next five years.

In terms of sector preferences, family offices report a growing interest in real estate, with 29% planning to increase their allocations to the sector. Meanwhile, 46% intend to maintain their current real estate exposure.

Family office portfolios remain heavily weighted toward Western markets:

- North America and Western Europe together absorb 79% of global family office wealth.

- The Asia-Pacific region (excluding China) and China each account for only 7% of allocations.

- This limited exposure to Asia reflects a growing sense of caution among family office managers, driven by concerns over political and geoeconomic developments in the region.