According to BNP Paribas Real Estate' data, investor interest in retail assets is focused on specific markets, although it is slowly gaining more market share (19% in Q1 2024 vs. 18% in Q1 2023) . In fact, as the analysts report, these levels (19%) have not been observed for 5 years.

A total of €15.9 billion was invested in the European retail sector in the last 12 months, with Shopping Centers making up 23% of transactions and high street stores 26%, recording, however, a strong year-on-year decline in both categories .

However, in some countries, over the past 12 months, retail has been one of the hottest commercial asset classes, carrying out the most transactions. More specifically, in Germany, investors allocated as much capital to retail (26%) as almost to the logistics sector (28%) and for the first time they are even ahead (23%) of offices.

At the same time in Spain, retail is the second largest real estate sector after hotels with 24% of the total. Bucharest is becoming a more popular tourist destination and this could lead to an increase in demand for retail space in the city, according to BNP Paribas Real Estate. In addition, the Romanian government is investing heavily in infrastructure projects, which it hopes will make it easier for retailers and consumers to have better access to the city center.

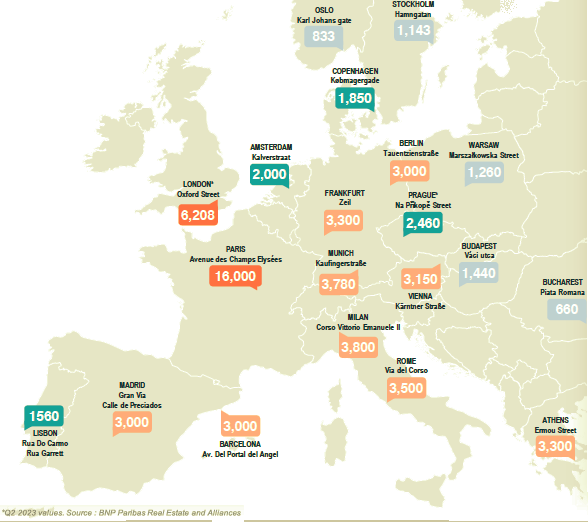

The Greek market shows stabilizing trends with Athens and the prime location of Ermou Street picking up after the decline during the pandemic years, and rents reaching €3,300 / per square meter in the fourth quarter of 2023 on an annual basis and the street Bucharest at €2,500.

Key operating metrics are performing well in terms of retailer turnover, performance and rent payments. Expectations for an increase in rents, in fact, are, as market players say, stable today.

The restructuring of the network of stores of many chains in retail (especially clothing and footwear) continues to be a trend with the demand of the center of European cities (among them Athens) being at high levels after the Covid era.