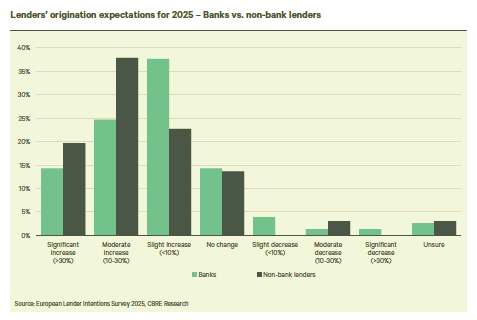

After two years of subdued lending activity, nearly 80% of lenders expect an increase in the volume of new loan originations in 2025 compared to 2024, according to CBRE’s recently released European Lender Intentions Survey 2025, conducted between March 24 and April 25, 2025. This upward trend is anticipated to further strengthen the European real estate market.

Notably, non-bank lenders—such as debt funds, insurance companies, and investment banks—demonstrate an even stronger appetite for expanding their lending activity than traditional banks. While the majority of all lender types plan to grow their operations, non-bank institutions are the ones forecasting the most pronounced increase.

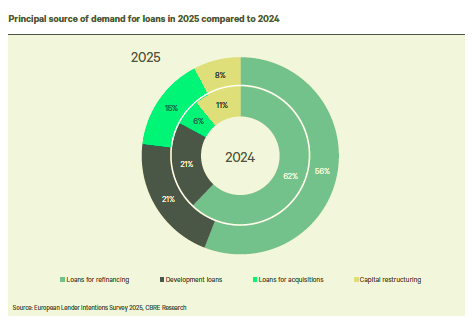

Refinancing Outlook

The year 2025 is shaping up to be a pivotal one for the real estate lending sector, primarily due to the large volume of loan maturities originating from the previous market peak. As a result, refinancing remains the dominant driver of lending demand. At the same time, the recovery in the transactions market is fueling renewed interest in acquisition financing for existing properties. Meanwhile, development loans—particularly for ground-up projects—remain relatively stable, accounting for just over 20% of total lending activity.

Despite the prevailing positive momentum, significant challenges remain. The uncertain geopolitical landscape has now emerged as the primary concern for 2025, cited by nearly 70% of survey participants as the most pressing challenge—a dramatic rise compared to 2024, when it ranked only fourth.

Rounding out the top five challenges are: persistently low investment activity, fears of a potential recession, uncertainty regarding future property valuations, and the unpredictable trajectory of interest rates.

Overall, the survey reveals a strong intention among lenders to increase their lending activity in 2025, notwithstanding the considerable external headwinds. The growing confidence—particularly among non-bank lenders—could serve as a catalyst for the continued recovery of the European real estate market. On the borrower side, there is a willingness to absorb the additional cost, as private lenders appear prepared to offer more flexible repayment terms.

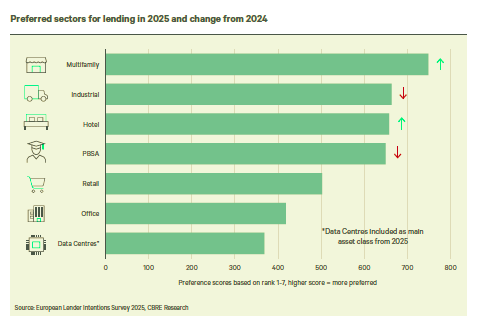

Preferred Sectors for Lending in 2025

Multifamily residential properties have emerged as the top choice for lending in 2025, selected as the preferred sector by 48% of respondents. Last year, this position was shared with logistics warehouses, which have now slipped to second place. Hotels have moved up to third, with 14% of respondents identifying them as the most attractive asset class. Student housing, retail, and office spaces follow in the rankings.

Finally, while data centers continue to attract attention, some lenders remain unequipped to finance this asset category.