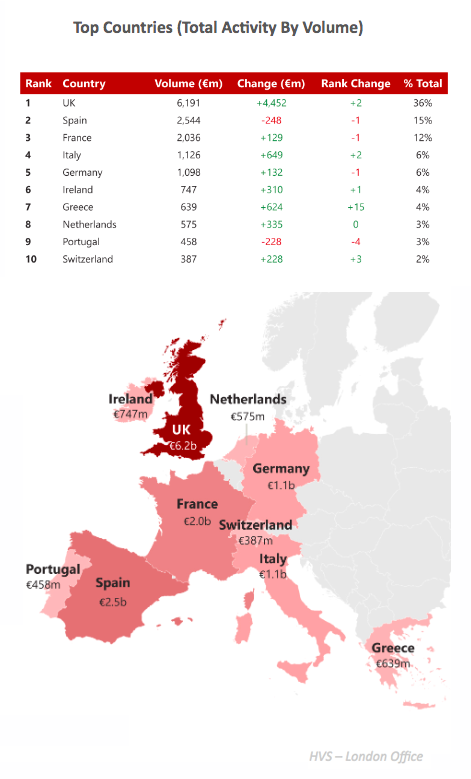

According to HVS's recent 2024 European Hotel Investment Market Review, most transactions took place in the United Kingdom, while investment in the tourism sector is steadily gaining ground in Southern European countries such as Spain, Italy, and Greece.

Transaction volume increased by 62% (+€6.7 billion) compared to 2023, reaching €17.4 billion — the highest level since 2019 — although still approximately two-thirds of the 2019 volume. Portfolios accounted for nearly 40% of total volume.

The average price per room was €215,300, marking a 9% increase compared to 2023 and about 5% higher than in 2019.

The average hotel price was €29 million, a 5% increase from 2023, while the average number of rooms per hotel decreased by 3%, reaching 135 rooms.

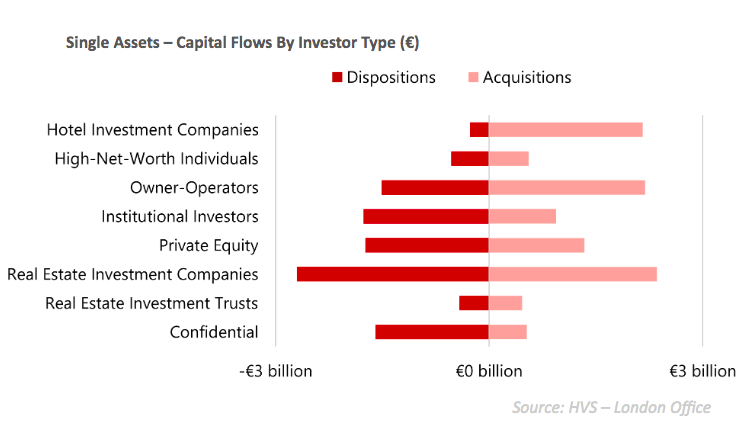

Most transactions were carried out by Private Equity firms, with a total transaction value of €8.6 billion — a 315% increase compared to 2023 — followed by Owner-Operators, with €7.8 billion in transactions, a 90% increase from 2023. Real Estate Investment Companies (REICs) conducted transactions worth €5.9 billion, a slightly lower figure compared to 2023.

Institutional investors were net sellers, with a negative balance of €1.7 billion, reflecting their cautious stance due to high interest rates.

European investors made the most placements, participating in 82% of single-asset transactions in 2024, with net purchases amounting to €2 billion. On the sellers' side were North American investors, who recorded net sales of €722 million, while Asian investors remained essentially unchanged, accounting for 5% of the total volume.

source: HVS