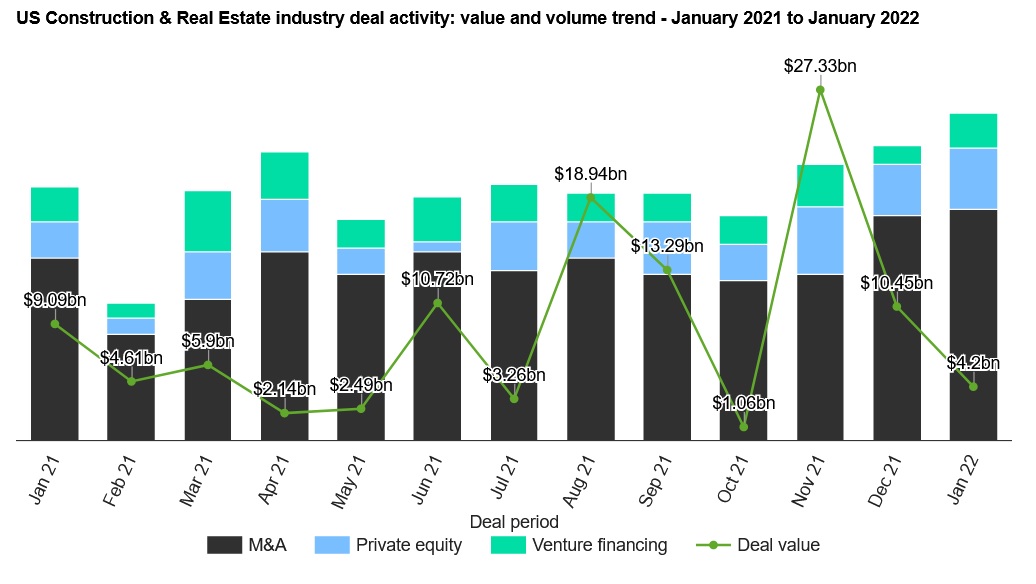

A total of 107 construction & real estate industry deals worth $4.2billion were announced for the region in January 2022, against the 12-month average of 84 deals.

Of all the deal types, M&A saw most activity in January 2022 with 77 transactions, representing a 72% share for the region.

In second place was private equity with 19 deals, followed by venture financing deals with 11 transactions, respectively capturing a 17.8% and 10.3% share of the overall deal activity for the month.

In terms of value of deals, M&A was the leading category in North America’s construction & real estate industry with $4.1billion, while venture financing and private equity deals totalled $63.36million and $40million, respectively.

The top five construction & real estate industry deals of January 2022 tracked by GlobalData were:

1) Blackstone Real Estate Income Trust $3.7billion acquisition deal with Resource REIT

2) The $195million acquisition of PETILLO by Sterling ConstructionInc

3) Landsea Homes $179.3million acquisition deal with Hanover Family Builders

4) The $40m private equity deal for 35% stake in Banner Oak Capital Partners by Pacific Current Group

5) Byers Capital,Founders Fund,Initialized Capital,Khosla Ventures,LenX and Zigg Capital $30million venture financing deal with Culdesac

(source:designbuild)