However, according to a Principal Asset Management (PAM) recent analysis, the post-pandemic recovery has markedly differed from the rebound following the Global Financial Crisis (GFC). Transactions nearly doubled in 2021 compared to the previous year, approaching historic highs. In 2022, transaction volumes remained robust, reflecting continued strength in the market.

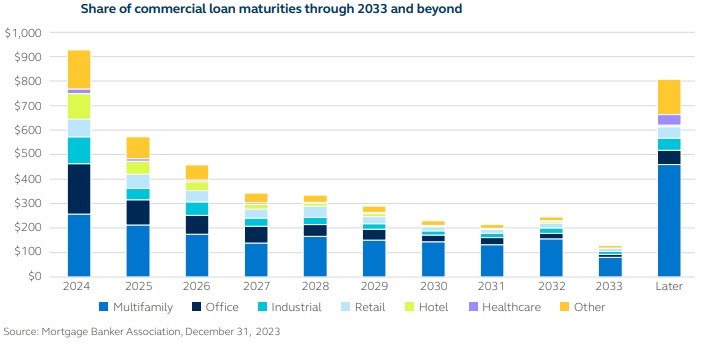

Given the mix of loan maturities in the sector—comprising 3-year, 5-year, 7-year, and 10-year terms—loans that were issued in early 2021 and fall into the 3-year maturity category are now reaching their maturity dates. Similarly, loans issued in 2022 will begin to mature in the coming year.

It is expected that some of these loans will be renewed, which will shift the pressure to 2025 and 2026. Of the $700 billion in loans that matured in 2023, $271 billion was renewed for 2024, with further renewals anticipated in 2025 and 2026.

According to Principal Asset Management, approximately $2 trillion in commercial real estate mortgage loans are set to mature over the next three years. Borrowers will need to refinance or recapitalize these loans, generating significant demand for capital.

office

The office sector represents approximately 14% of loan maturities through 2026. Only high-quality deals closing during this period are likely to secure funding, as market sentiment towards office properties remains highly negative. Distressed investors may become more active in the sector if the trend of workers returning to office spaces gains momentum.

Industrial

The industrial real estate sector accounts for approximately 10% of loan maturities through 2026. While some easing is currently being observed, the sector maintains strong momentum, according to Principal Asset Management, driven by the ongoing growth of e-commerce. This growth is contributing to an increased demand for industrial space. E-commerce continues to expand at a rate of 13-14% annually, further fueling the need for distribution centers, fulfillment hubs, and warehouses.

Retail

The retail sector represents nearly 9% of loan maturities through 2026. The sector experienced significant impairments following the Global Financial Crisis, with values further declining during and immediately after the pandemic. However, today, prime shopping malls and grocery stores are performing strongly, demonstrating resilience in certain subsectors of retail.

The combination of a substantial volume of upcoming debt maturities and positive outlooks for certain sectors presents opportunities for strategic investments. With a significant amount of debt set to mature, hundreds of billions of dollars in transactions are expected across these sectors in the coming years. This creates strong potential for capital growth, as supply remains constrained and demand continues to strengthen.