Inflation is falling in most of

the major economies around the world, meaning greater predictability is

returning to consumer and producer prices – and to construction costs too, even

if they will remain high.

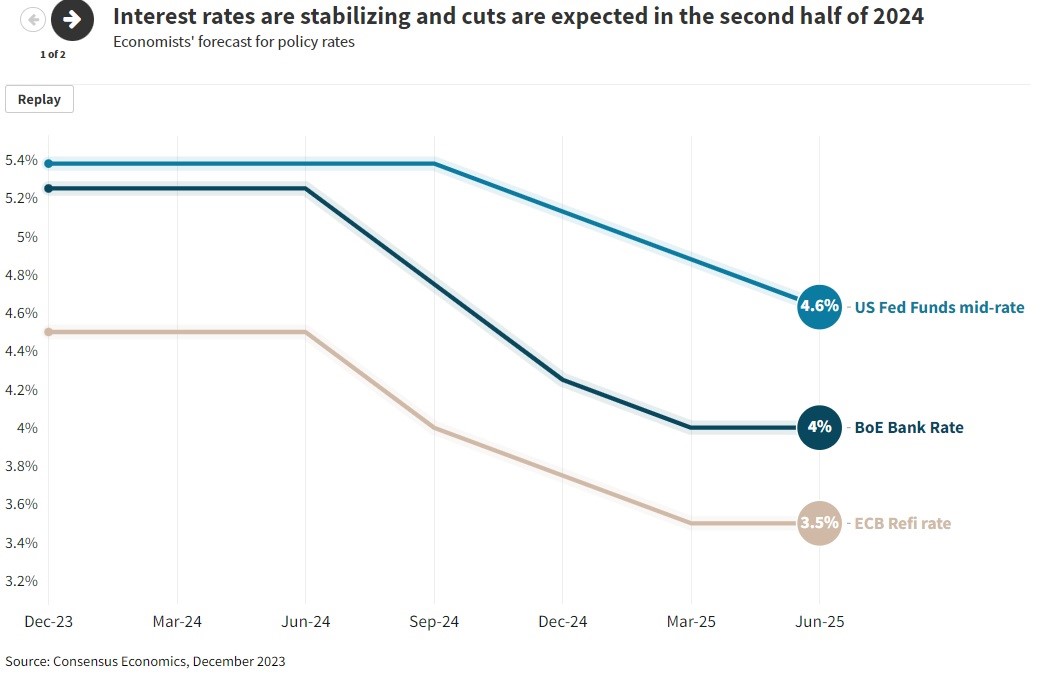

Interest rates in most developed

economies have now peaked after aggressive monetary tightening in 2022 and

2023, and policy rates are likely to be stable until the cutting cycle begins

in mid-to-late 2024. With future policy rate movements likely to be downward,

borrowing costs will fall.

Office utilization has improved

globally and has mostly stabilized in Asia and parts of Europe. In the U.S.,

return-to-office mandates have become more widespread, and we expect

utilization to continue to increase incrementally in 2024, and revitalizing CBDs

with renewed daytime foot traffic and retail demand.

In a market where credit remains available and active, the stability and predictability of interest rates will be more important to the improvement in investment market activity than the level of borrowing costs alone. Real estate credit strategies will remain in focus amid the elevated interest rate environment, and new sources of debt are arising to complement funding options in markets and sectors where lenders are more cautious. Given the declines in real estate values to date, there will be many situations where new equity is required to meet debt service covenants.

What to expect by sector

Living sectors

The Living sectors will remain a bright spot in 2024 and beyond for many reasons. An expanding world population is becoming more urban, meaning cities require more homes, as well as a broader range of household types and sizes. Long-term structural trends like ageing populations, demand for education, and housing availability remain critical drivers of housing demand and will continue to benefit Living investment strategies across more markets globally. In the near-term in 2024, some markets will see distress and micro over-supply situations as interest rates and concentrated new construction in growth markets have an impact.

Logistics

The growing emphasis on regionalization and local manufacturing will continue in 2024, as efforts to bring production closer to the customer and diversify supply chains broaden. The evolving global landscape of government incentives will bring new manufacturing into the advanced economies of North America and Europe, driving demand for industrial and logistics facilities. Urbanization and the evolution of consumer preferences that prioritize ever-faster delivery times will mean an intensifying focus on urban logistics. These trends will benefit not only the largest metros but the growing U.S. Sunbelt region as well.

Retail

Retail is poised for an evolving comeback in 2024. Investors are returning to a sector that earlier in the cycle transformed its supply-and-demand dynamics and its yield and rental profile to offer attractive returns and opportunities for renewed rental growth. In the U.S., high-quality, well-located retail – especially grocery-anchored – has been one of the top performing segments, with increasing investor allocations as consumers remain resilient from COVID-era stimulus amid strong job and wage growth. In Europe, the continued rebound in travel and tourism, and the return of positive real wage growth as inflation falls, will support turnover at a time of otherwise soft economic conditions. In China, the inclusion of some forms of retail into the CREIT scheme should bolster demand for retail assets; and the strong reception to India’s first retail REIT in 2023 could set the scene for rising investment into high-quality malls over the next year.

Strategic investing

Perhaps the biggest undertaking for real estate investors in 2024 will be to balance the financial and asset management challenges within their existing portfolios, with the desire to deploy capital to in-demand assets and take advantage of opportunities over the next 12 to 24 months. A defining characteristic of successful investors will be ambidexterity: the ability to execute offensive and defensive strategies, effectively deploy resources, and make decisions with conviction in a still uncertain climate. Many investment managers are having to contend with zero-to-negative return vintages, creating additional challenges including talent retention.

For real estate occupiers, JLL Research sees 2024 as a year to further solidify workplace policies and align portfolio strategies to new ways of working and revised growth trajectories. There will also be a mindset shift, as corporate real estate leaders move from operating static assets to managing dynamic workplaces, and occupancy levels and business requirements change within any given day or week.

Technology will be more critical in 2024 than ever before, as organizations test and learn from AI pilots and strive to harness and leverage the wealth of workplace data across their portfolios. One area in particular JLL sees ramping up further in 2024 is occupiers’ focus on sustainability. More than 50% of the world’s largest companies by market capitalization have announced science-based targets that link their future building demand to a carbon commitment.