Coastal and rural locations in sunnier climes saw skyrocketing average price growth

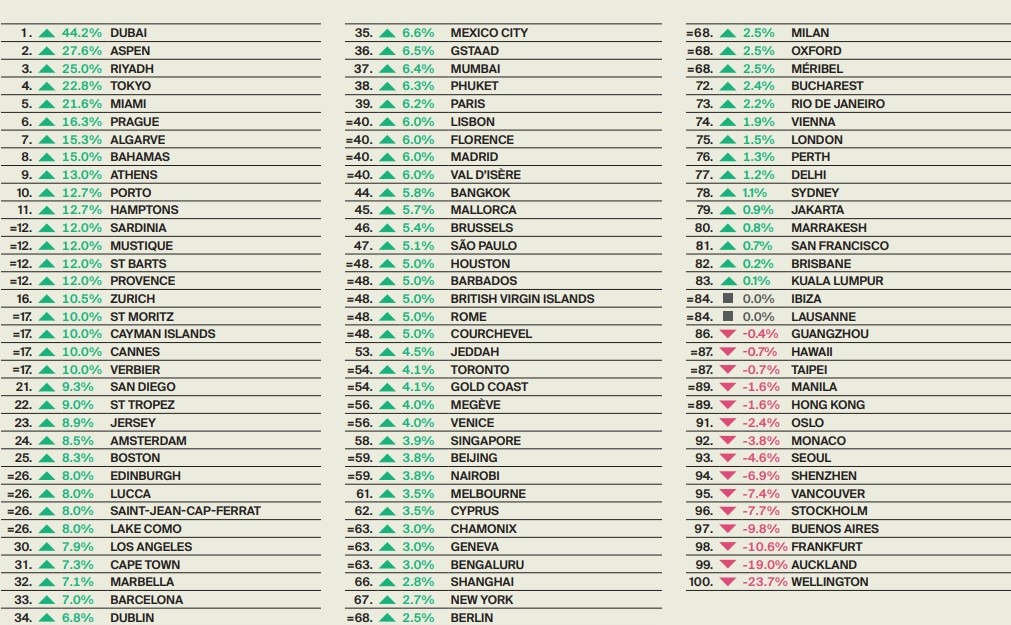

According to Knight Frank's "The Wealth Report 2023" resorts outperformed. Coastal and rural locations in sunnier climes saw average price growth of 8.4%, marginally ahead of ski resorts which were up 8.3% on average, eclipsing their 2021 record.

The Americas (7%) narrowly pipped Europe, the Middle East and Africa (6.5%) to the title of topperforming region, with Asia-Pacific trailing on 0.4%.

Athens claims its stake in the international pool of funds

Based on the results on city basis around the world and given the shift in investment towards luxury residential properties in warmer destinations, Greece deservedly claimed and gained market share.

According to the data published by Knight Frank's "The Wealth Report 2023", Athens was comprised in the top ten cities that recorded exceptional increases in the prices of luxury homes last year.

In first place was ranked Dubai with a price increase of 44.2% and Athens ninth, competing international destinations such as Porto and the Bahamas.

Knight Frank reffered to 2021 as “an anomaly” year. A year characterised by stellar price growth as markets reopened post-Covid, and revenge spending took hold. Off the back of such a boom, you might be forgiven for thinking 2022 would see a return to business as usual. Far from it.

Omit 2021, and 2022 posted the highest level of prime price growth on an annual basis (5.2%) since the global financial crisis (see page 37). But it was a year of two halves. Sentiment shifted gear in mid-2022 as inflation waved goodbye to its transitory status and the cost of debt ramped up, recession loomed, the Ukraine conflict led to rocketing energy prices and stock markets, not to mention crypto, went wobbly.

So what was behind the price growth? Wealth preservation, safehaven capital flight and supply constraints played their part, but the pandemic-induced surge clearly had more left in the tank. Covid-19 underlined the fragility of life and the need for connectivity, and sparked a mass transition to hybrid working.

For the world’s wealthy, this increased their appetite to buy, with 17% telling us they added to their portfolios in 2022.