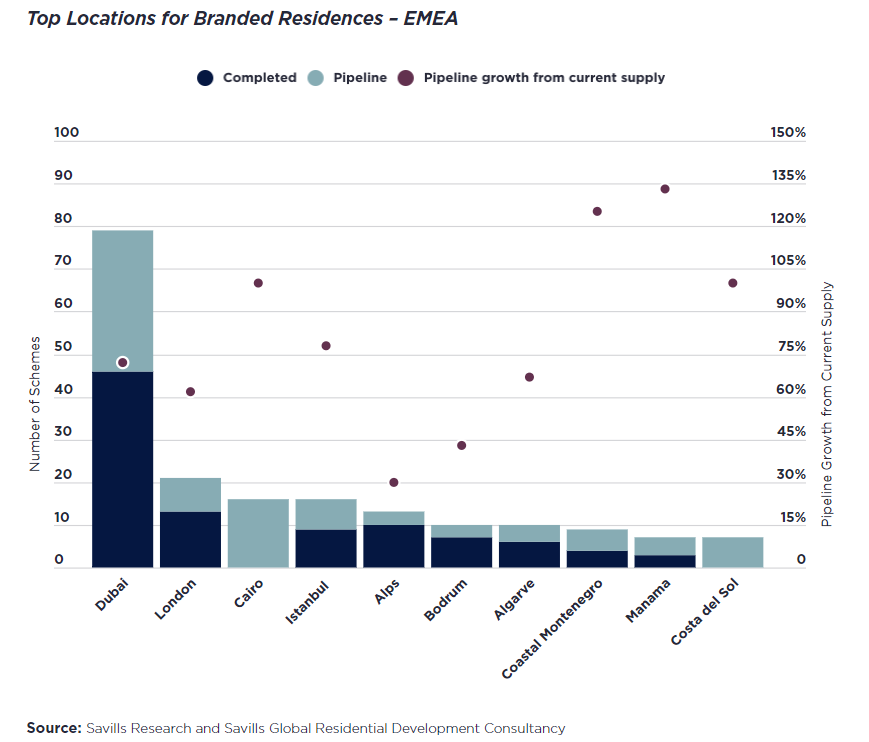

Accoridng to Savills' recently unveiled report “Spotlight: Branded Residences – EMEA”, the locations across the region which show the highest concentration of branded residences are as widely varied as the climates within it. From established locations such as Dubai, London, and the Algarve, to emerging centres such as Cairo, coastal Montenegro, and Manama in Bahrain, branded residences are expanding their reach and entering new markets.

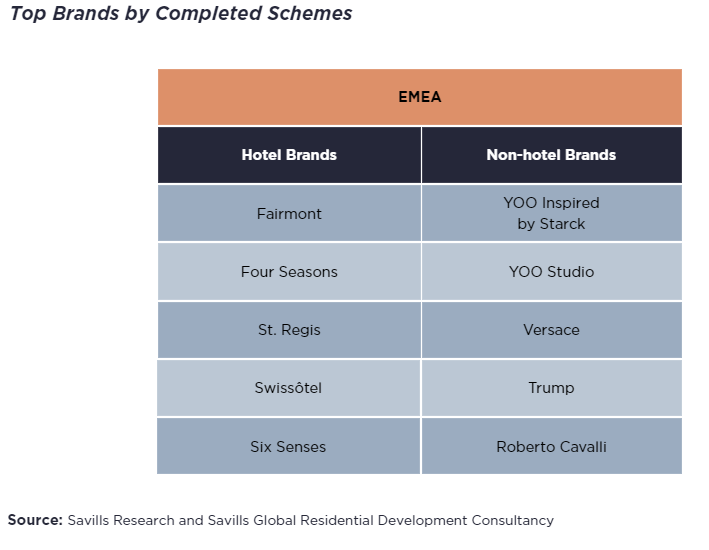

Across the EMEA region, branded residences from the luxury and upper-upscale chains account for nearly three-quarters of the total stock through the pipeline period. These properties tend to be in urban or urban-resort locations, with 62% of the total schemes in such locations.

However, all the hotel chain scales are continuing to expand their presence in the region, with each chain scale forecast to nearly double the number of properties existing in each category by 2030.

Many emerging markets across the region are forecast to see increases in supply of 50% or more through the pipeline period, though many locations are growing from a comparably lower base. Established markets and many world cities are forecast to see slightly lower growth as brands face significantly more competition from non-branded, luxury housing in desirable, prestigious and historic neighbourhoods which offer a great mix of amenities and lifestyle.

According to Savills, Dubai has the largest number of completed schemes and the most schemes in the pipeline for any market within the EMEA region, with projected growth of 72% over the pipeline period. A strong domestic and international supply of buyers searching for trophy assets with lock-up-and-leave potential have boosted the growth of branded residential schemes in Dubai over the past decade. Second in the rankings for completed and pipeline schemes is London, which also benefits from strong domestic and international interest in the sector. However, schemes in London must compete with branded and highly amenitised non-branded stock across the prime neighbourhoods for a limited number of buyers; as such, many schemes opt for top-of-the-line amenities and service as a point of differentiation. Meanwhile, markets with fewer projects in their networks, such as Bahrain and Montenegro, exhibit impressive, triple-digit growth, though they are growing from a much lower base.

The level of competition is clearly visible when examining the regional sector by chain scale. Branded residences have historically been led by luxury hotel brands, and remain as such, though brands in other segments are increasingly capturing market share as the supply of branded residences grows.

When compared to non-branded stock in many markets, branded residences can command price premiums though these vary by location and market maturity. Established markets with a strong supply of high-quality amenities and exceptional build quality may exhibit a lower brand premium compared to emerging markets where the average quality, specification, and servicing for non-branded product is of a lower tier. For emerging locations with limited options for wealthy buyers, branded residences can command attractive premiums, making them appealing for both developers and brands while retaining their appeal for domestic and international buyers.

Across the EMEA region, the average brand premium stands at 36% compared to non-branded stock, and six percentage points above the global average of 30%. Emerging markets, however, can command a much higher premium than can be achieved in established markets or global cities. Ultimately, each market is unique, and Savills possesses a customised premium analysis model to evaluate local premiums.

Branded residences, as a segment of the EMEA residential property sector, are predicted to continue their extraordinary growth. Brands across the globe continue exploring new locations to grow their market share. Internationally mobile individuals, able to live and work from any location, will also continue to drive demand for branded residences. Rising numbers of wealthy individuals globally will likely create a new source of aspirational HNWIs who will look to have a base in Europe.

Across the EMEA region, the number of HNWIs has grown by 27% in the past five years, providing an expanding client base for branded residential schemes. From global cities and established markets to resorts and emerging locations with their wealth of newly affluent buyers, the opportunities for branded residences remain strong. Brands are seizing these opportunities and expanding their portfolios across the region, with supply of schemes projected to grow 60% by 2030. More flexible working patterns and the focus on wellness will also likely continue to support the expansion of the sector in leisure destinations along the coasts as well as in ski resort markets.

.jpg)