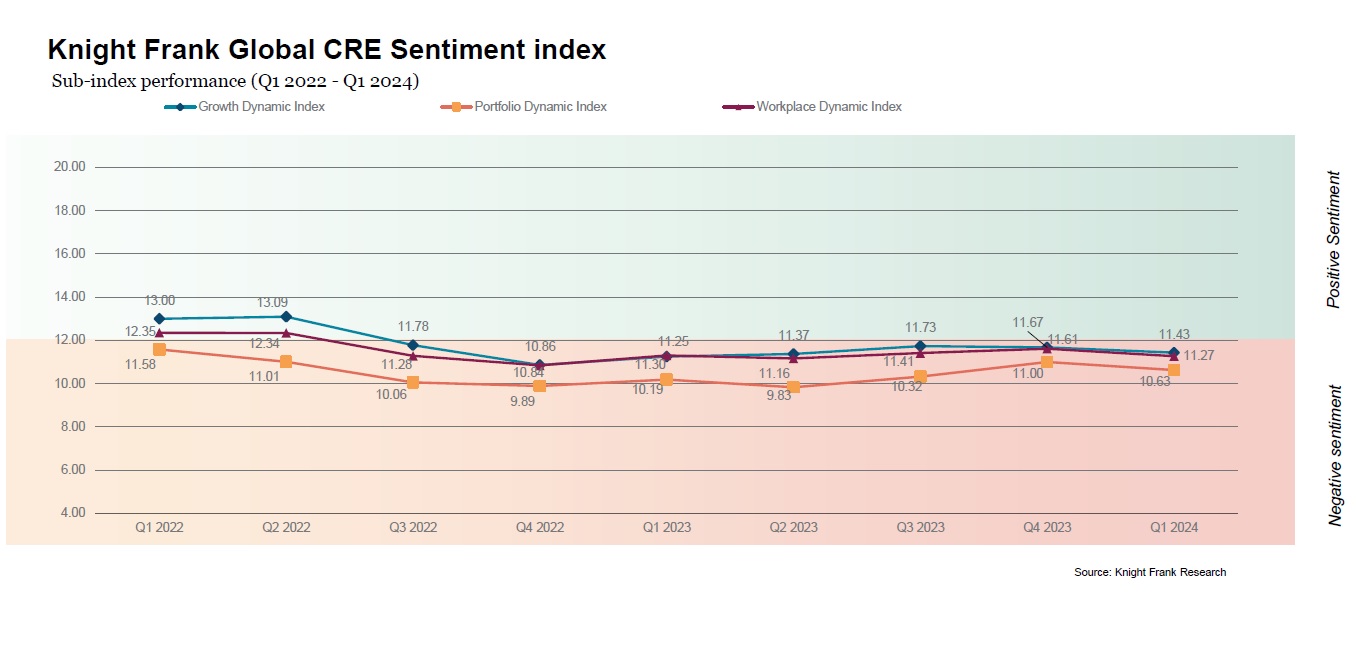

This was recorded in the business sentiment index and is attributed to the increase in capital expenditures and the reduced supply of specialized executives. Thus it was not possible to maintain the momentum developed in the last two quarters of 2023 and the index declined.

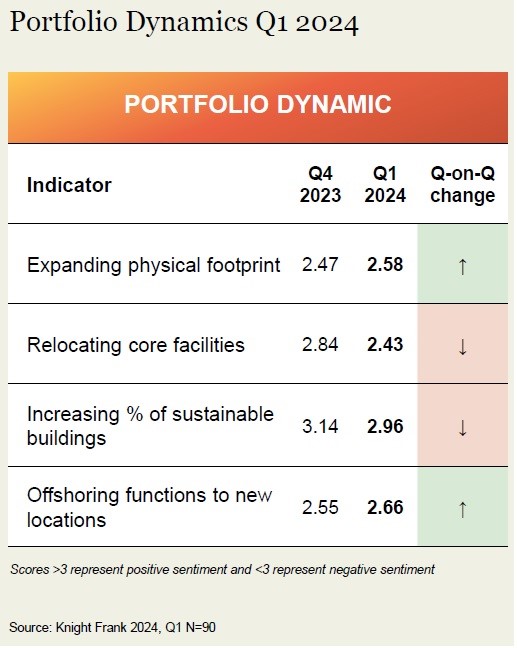

After a strong increase in Q4 2023, Portfolio Dynamics fell back in the Q1 survey. It should be noted, however, that the sub-index score of 10.63 is the second strongest reading since Q3 2022.

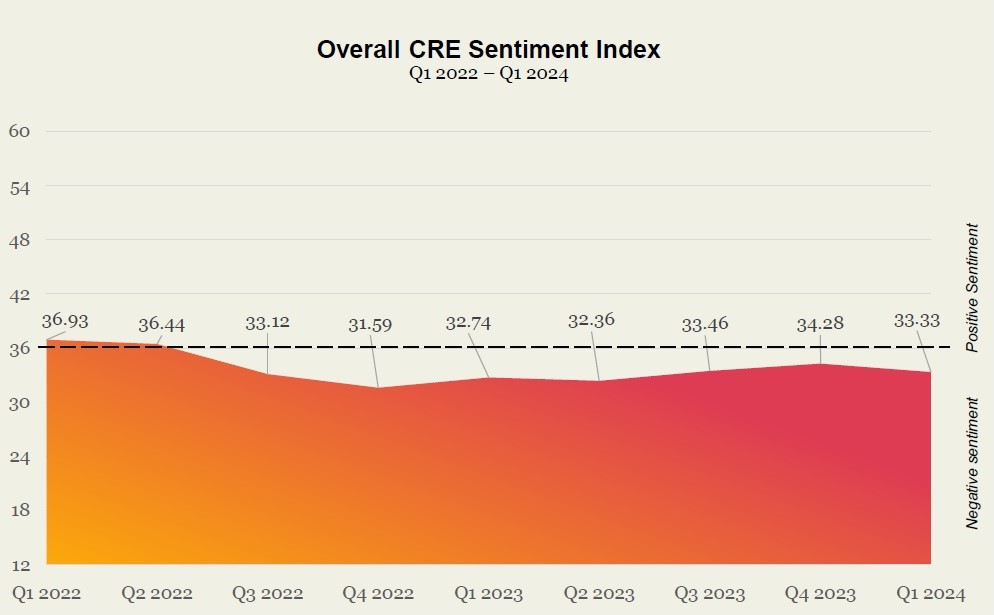

Overall sentiment for real estate company leaders moderated in the first quarter of the year after two consecutive quarters of improvement. All 3 sub-indices recorded a decline. The business sentiment index fell overall by 0.95 points, to 33.33.

All three sub-indices sit below critical level

All three sub-indices sit below a score of 12, which is the tipping point between negative and positive.

sentiment.

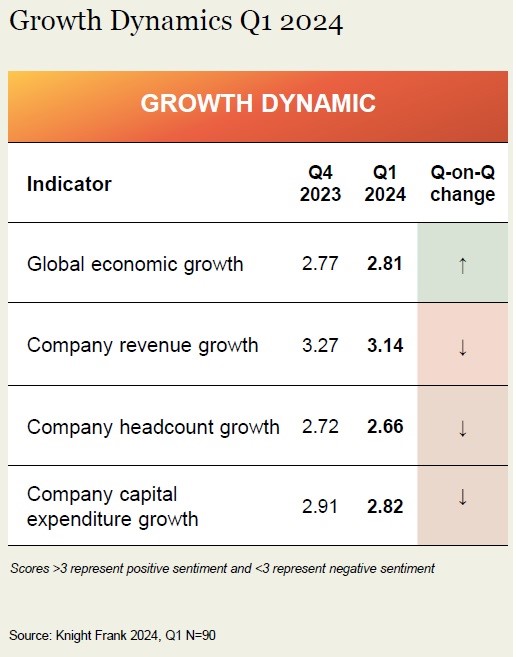

The growth dynamic sub-index reduced by 0.24 points q-on-q to stand at 11.43. At a macro-level, sentiment relating to global economic growth continued to improve steadily. A score of 2.81 suggests a more positive sentiment around the trajectory of the global economy following a period of concern around recessionary pressures. In fact, that score is the 3rd highest reading for global economic growth since the survey began in Q1 2022.

After strong increases during Q3 and Q4 2023, the portfolio dynamics sub-index fell back by 0.37 points in Q1. However, it remains at its second highest reading since Q3 2022. This suggests that addressing portfolio level challenges is shaping current CRE thinking.

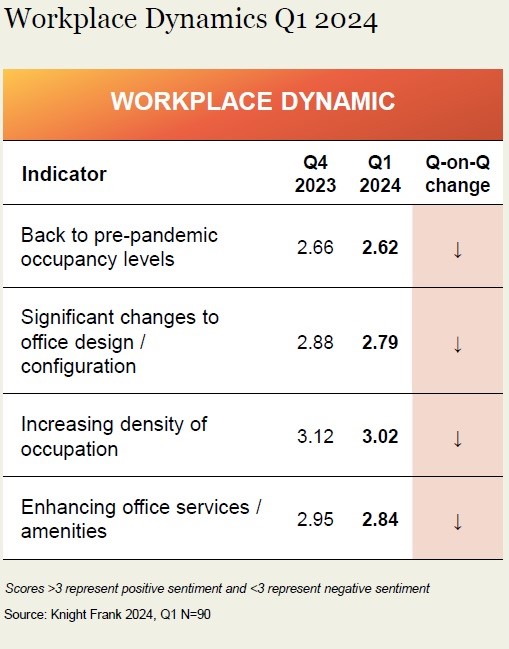

Sentiment was weakest in relation to the future enhancement of office services and amenities. While keeping with levels seen since 2023.

What's next

A sustainability impulse is still there for the majority of occupiers but the ability to enhance sustainability credentials at the portfolio level are hindered by limited capex and supply-side constraints.

Relocation as a reaction to functional and physical building obsolescence is a real pressure, but capex again limits short-term response.

According to Knight Frank the constraints on capital expenditure are clear and will hold back any progress on a large number of capital-dependent projects such as extensive renovations.