During the third quarter, c.6.3 million sqm of logistics spaces were leased or 14% above the levels of the previous quarter. Rising occupier activity during the quarter pushed total take-up to 17.8 million sq m.

Demand for more space remains high as construction activity struggles to keep up with demand for new high-end space with the European average vacancy rate at 4.3%, marginally down from 4.4% in the second quarter, but significantly above the 3.3% recorded by JLL a year ago.

Πηγή: JLL

While the increase in available space may bring some relief, modern, energy-efficient space remains limited in most European markets, and the question remains of how much of the remaining available stock can be retrofitted to meet the minimum requirements. energy efficiency, with the aim of repositioning it on the market and avoiding its disuse.

On rents, the weighted average European core rent growth rate reached 10.8% year-on-year in the third quarter - up from 15.6% year-on-year in 2022, but above the 5-year average rate of 5.9% 2018-2022.

Finally, in terms of investment activity, nearly €6.7 billion was invested in European industrial assets in the third quarter of 2023, pushing transaction volume in the first nine months of the year close to €17.7 billion.

The condition in the Greek real estate market

Increased demand is also observed in the Greek market, with total investments exceeding €150 million, most of which have been made in Western Attica. Investors in our country are also targeting prime assets with fixed deliveries, with a total of approximately 120,000 sqm of industrial and logistics space having been absorbed in the 3rd quarter of 2023 alone, significantly higher than the corresponding period last year, according to the latest report of C&W/Proprius

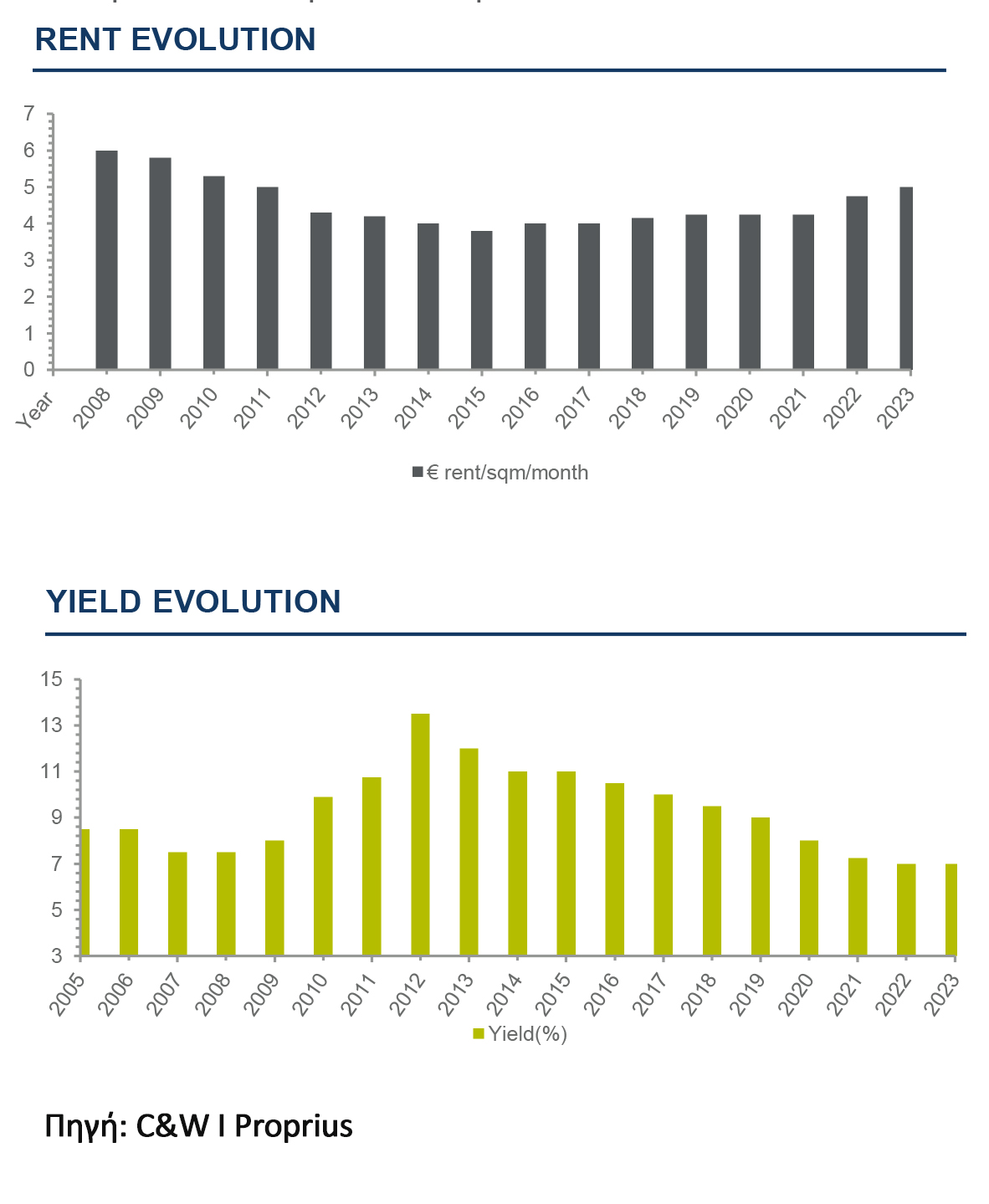

Rents increased by 5% (year-on-year change) as a result of increased demand versus supply, but also due to increased construction costs. The demand comes mainly from logistics and transport companies producers, but also from end users.

Basic rents amount to approximately €5.25/sq.m. in Athens and €4.25/sq.m in Thessaloniki, with higher rents for LEED certified assets.