A significant increase in accommodation demand is revealed by JLL's recent Global Hotels Investor Sentiment Survey, at a time when revenue per available room (RevPAR) is up by 10.2% compared to 2019.

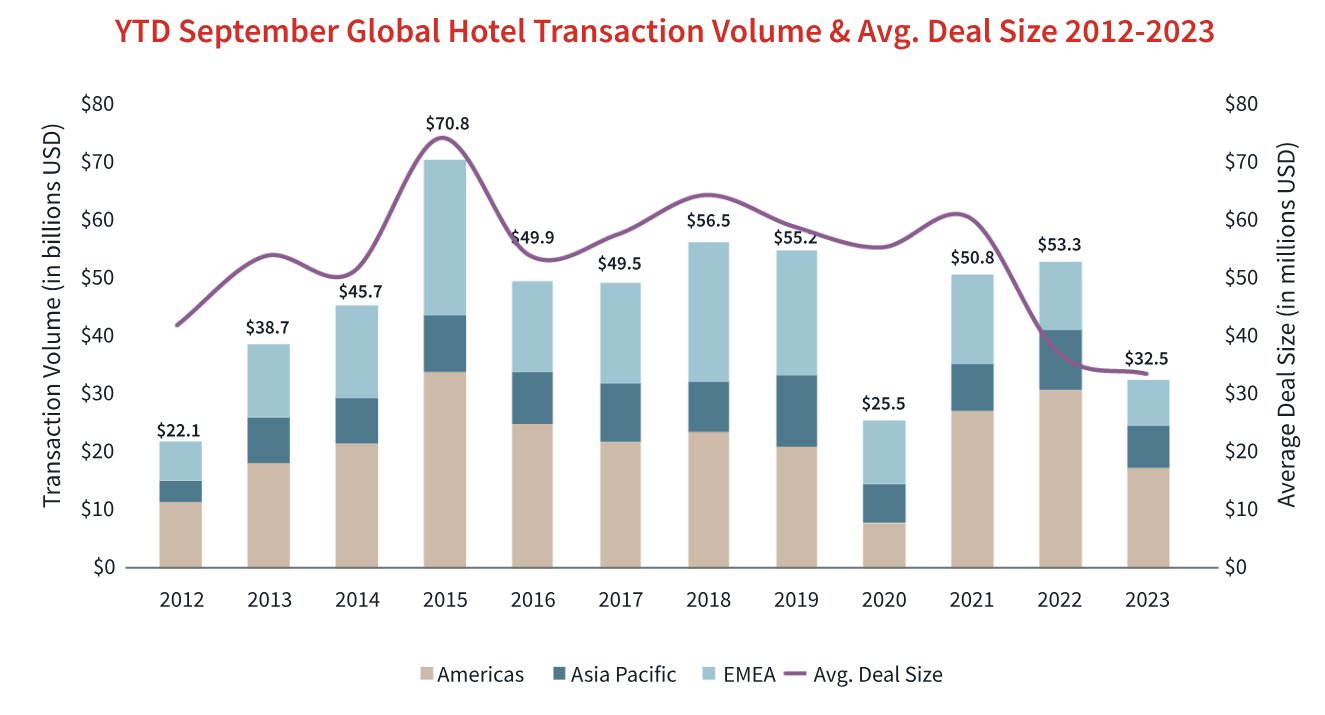

Despite robust fundamental performance, global hotel investment volume has been sluggish in 2023, sinking to a 10-year low (excluding 2020) of $32.5 billion through the first nine months of the year, underpinned by widespread macroeconomic headwinds, namely high debt costs and capital market dislocation. Widespread capital market dislocation, particularly high debt cost from most of the world’s central banking institutions has led historically low portfolio transactions and declines in average deal size.

Source: JLL

Despite the fact that some of these headwinds persist and others may arise, investors remain optimistic with most expecting to be net-buyers over the next year and looking to deploy increased capital into the hotel sector. As a result, JLL expects the global lodging industry to remain resilient and attract increased investment over the next 12 months.

While hotel investors are closely monitoring the RevPAR recovery profile of their hotel portfolios, many are also aware of the broader challenges in the market that will impact the sector’s performance, liquidity, and their ultimate ability to transact. The top three challenges investors shared in this year’s survey are:

• Cost of capital

• Rising insurance costs underpinned by growing climate risk

• Deferred capex, with many brands reinstituting performance improvement plans

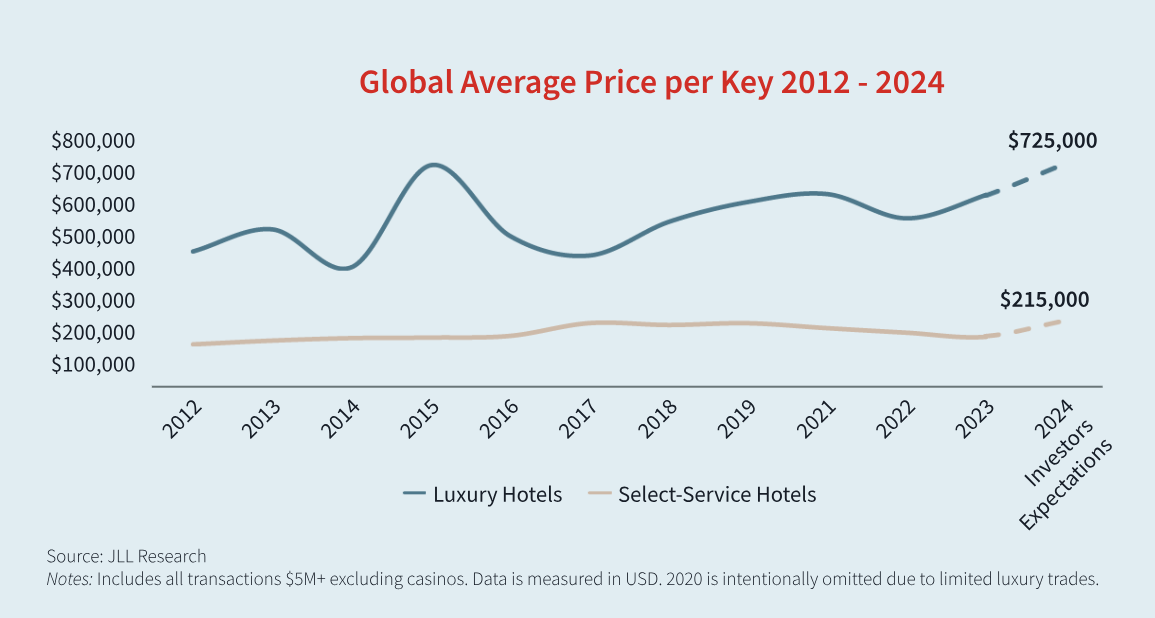

However, investors generally remain optimistic that deal flow will accelerate over the next 12 months. Luxury assets, along with the select-service and extended-stay sectors are expected to be the largest recipients of capital, driven by the growth in global wealth and the continued blurring of lines between living and travelling.

Moreover, global urban markets such as London, New York, and Tokyo emerge as the most appealing for hotel investment, underpinned by accelerating fundamental performance. Many investors expect this growth to continue, reinforced by accelerating group and business travel demand, particularly to gateway markets. As such, 84% of global hotel investors expect to deploy the bulk of their capital towards urban markets, with Tokyo (20% of APAC investors), London (10% of EMEA investors), and New York (10% of Americas investors) expected to be the largest recipients of capital over the next year.

Source: JLL Global Hotels Investor Sentiment Survey