The outlook is for increased activity on the back of more attractive yields, with prime rents rising and repricing starting to re-align buyer and seller expectations. However, this wider view encompasses significant regional and sector variations.

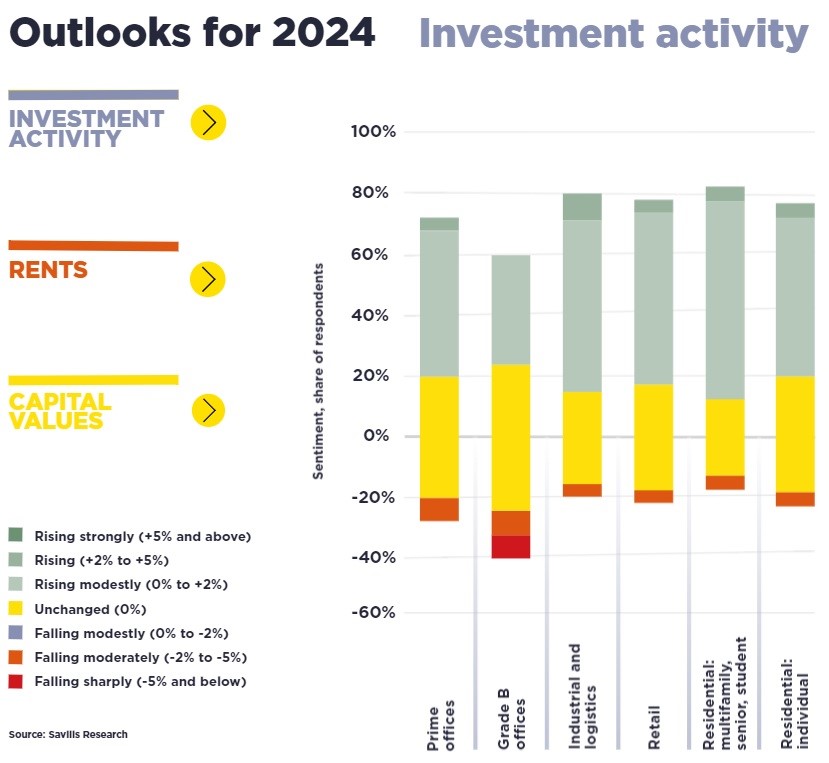

According to Savills the outlook for global property is becoming more positive. Investment activity is expected to rise moderately or remain unchanged across most property sectors in Europe and the Middle East next year. Only a small minority of those responded to Savills expect activity to decline, so the worst of the contractions caused by rising interest rates appears to be behind us.

There is most optimism about activity in residential markets, particularly the multifamily sector, where demand outstrips supply in many areas. Buoyed by strong fundamentals, the logistics property market also looks set to perform well in 2024.

It’s a more mixed outlook for offices, however, especially outside the prime sector, where 16% of respondents expect investment activity to decline next year.

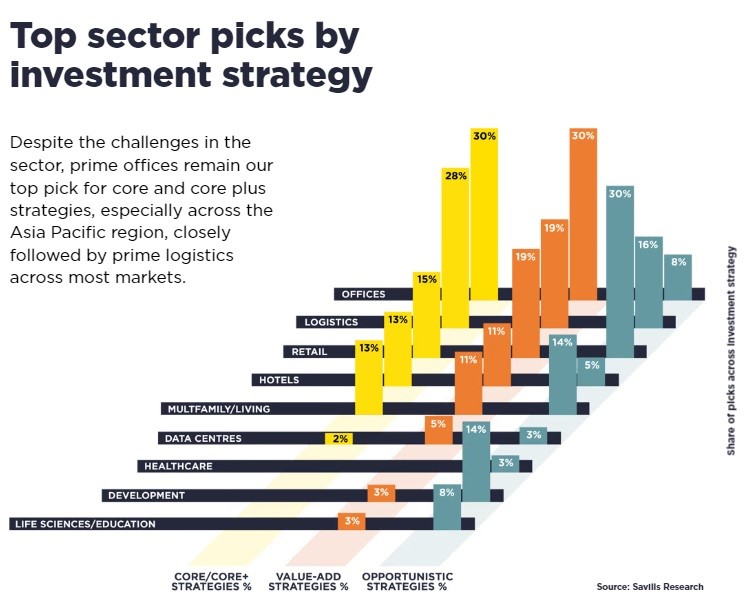

Overall, 5% to 10% of respondents anticipate a strong rise in investment activity. We believe this will be driven primarily by prime purchases, alongside opportunistic investments in distressed assets that are expected to come to market.

The prime hotel and retail sectors in tourist destinations in Southern Europe, Singapore and Australia present significant opportunities, as do the residential sectors in cities in Japan, Singapore, Germany, Spain, Italy and the UK, where supply cannot meet rising demand for rental accommodation.

A key theme for value-add strategies is office or retail space with the potential to be retrofitted or repositioned for higher rental returns. Repositioning of retail in southern Europe and Asia represents a significant value-add opportunity – as does repositioning of offices in prime locations in the Netherlands, Spain, Japan, South Korea, Australia, France and Germany.

Those looking for more opportunistic investments may want to look at properties offering the potential for development and repurposing. This might involve repurposing offices into living and hospitality facilities, or reformating old shopping centres.

Strong drivers of demand and limited supply underpin the considerable investment potential of smaller and less liquid sectors such as data centres, life sciences and education.