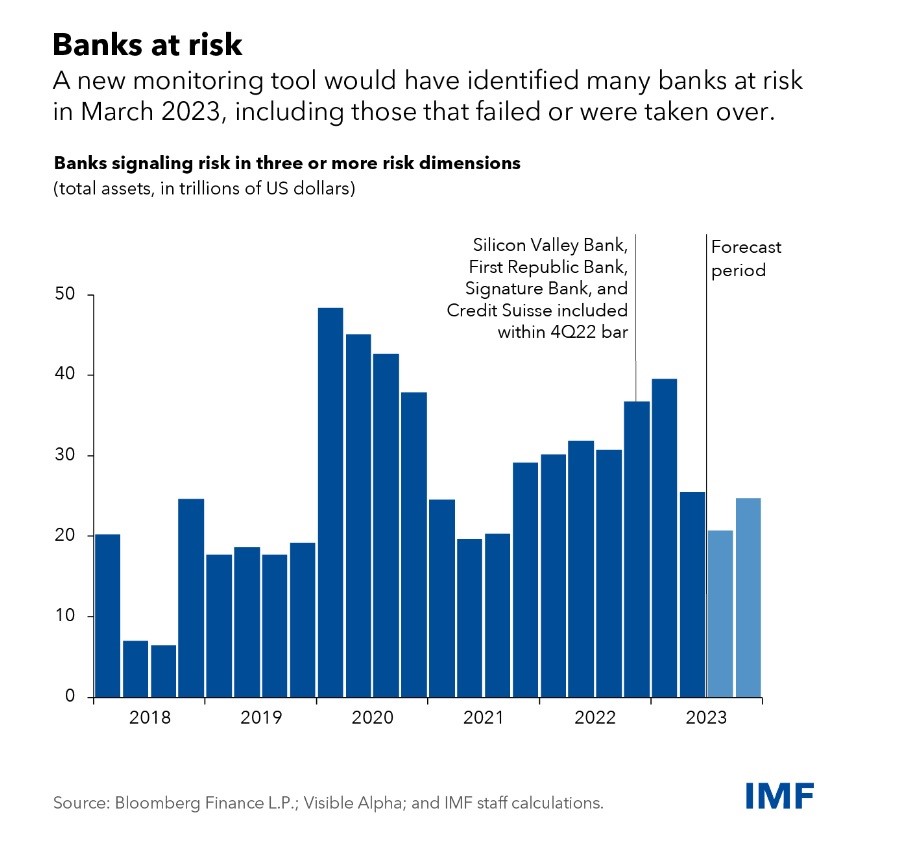

Such an environment hasn’t confronted the world’s financial markets in a generation. That means financial supervisors must sharpen their analytical tools and regulatory responses to address emerging threats. And the new risks gathering in the banking system and beyond mean it’s time to redouble efforts to identify the weakest lenders.

Rising rates are a risk for banks, even though many benefit by collecting higher interest rates from borrowers while keeping deposit rates low. Loan losses may also increase as both consumers and businesses now face higher borrowing costs—especially if they lose jobs or business revenues. Besides loans, banks also invest in bonds and other debt securities, which lose value when interest rates rise. Banks may be forced to sell these at a loss if faced with sudden deposit withdrawals or other funding pressures. The failure of Silicon Valley Bank was a dramatic example of this bond-loss channel.

The banking system appears broadly resilient, according to our new global stress test of almost 900 lenders across 29 countries, outlined in a chapter of IMF's latest Global Financial Stability Report.

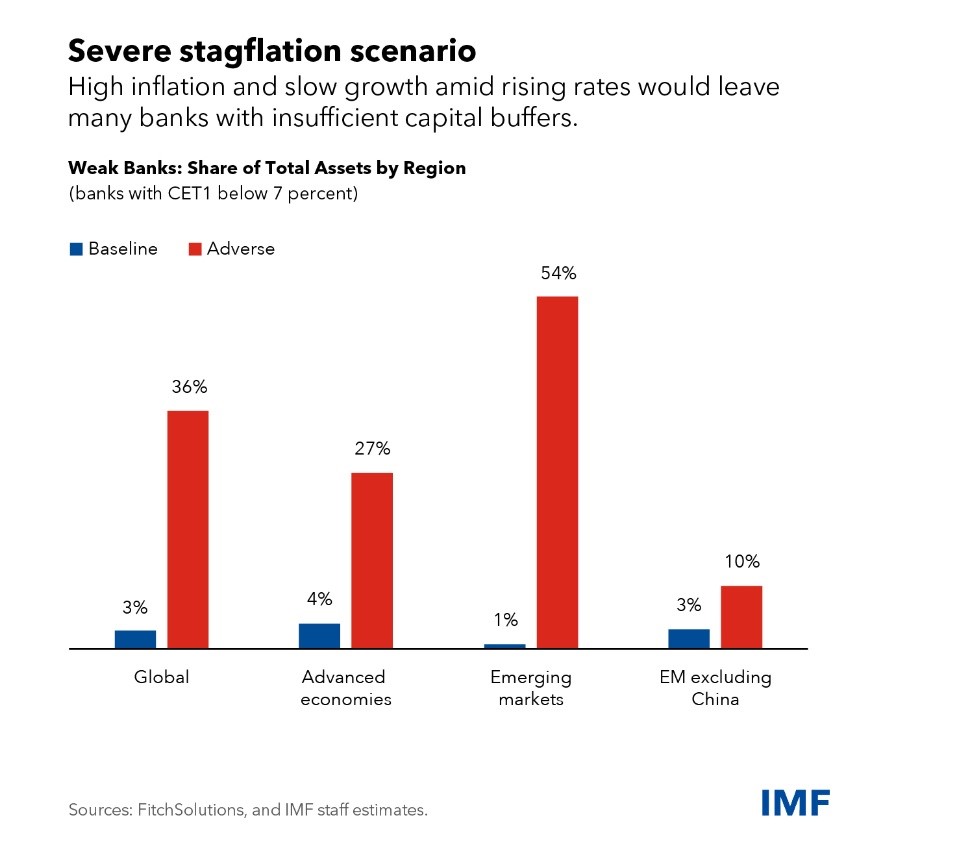

The fund's exercise, which shows how lenders would fare under the baseline scenario they project in the latest IMF World Economic Outlook, identified 30 banking groups with low capital levels, together accounting for about 3 percent of global bank assets.

But if beset by severe stagflation—high inflation with a 2 percent global economic contraction—coupled with even higher central bank interest rates, the losses would be much greater. The number of weak institutions would rise to 153 and account for more than a third of global bank assets. Excluding China, there are many more weak banks in advanced economies than in emerging markets.

Based on current market data and consensus analyst forecasts, these indicators point to a substantial group of smaller banks at risk in the United States, and concern for some lenders in Asia, including China, and Europe as liquidity and earnings pressures persist.

Now that banking strains have abated, the institutions and their regulators and supervisors should take this time to increase resilience. And they should prepare for a possible resurgence of these risks, as interest rates may stay higher for longer than currently priced in markets.

(source: International Monetary Fund)