Of the 30 major global cities in Savills index, 17 will record slower capital value growth than in 2022. However, 13 cities are forecast equal or even slightly enhanced growth in 2023, and rental markets will remain a bright spot.

Low to modest levels of capital value growth is forecast in the southern European cities of Lisbon, Athens, Rome, Milan, Barcelona and Madrid, where prime property is particularly coveted in times of economic turmoil as a safe haven asset and inflation hedge. Among them is the Greek capital, that according to Savills, may see an increase of 0%-1.9%, compared to last year.

Lisbon, a star performer in 2022, looks set to see continued but slower growth, as it attracts a broader base of international buyers in 2023. Southern Europe’s top performer in 2022, Milan, is expected to cement its position in 2023, with price growth of between 4% and 5.9%.

Where Athens is listed

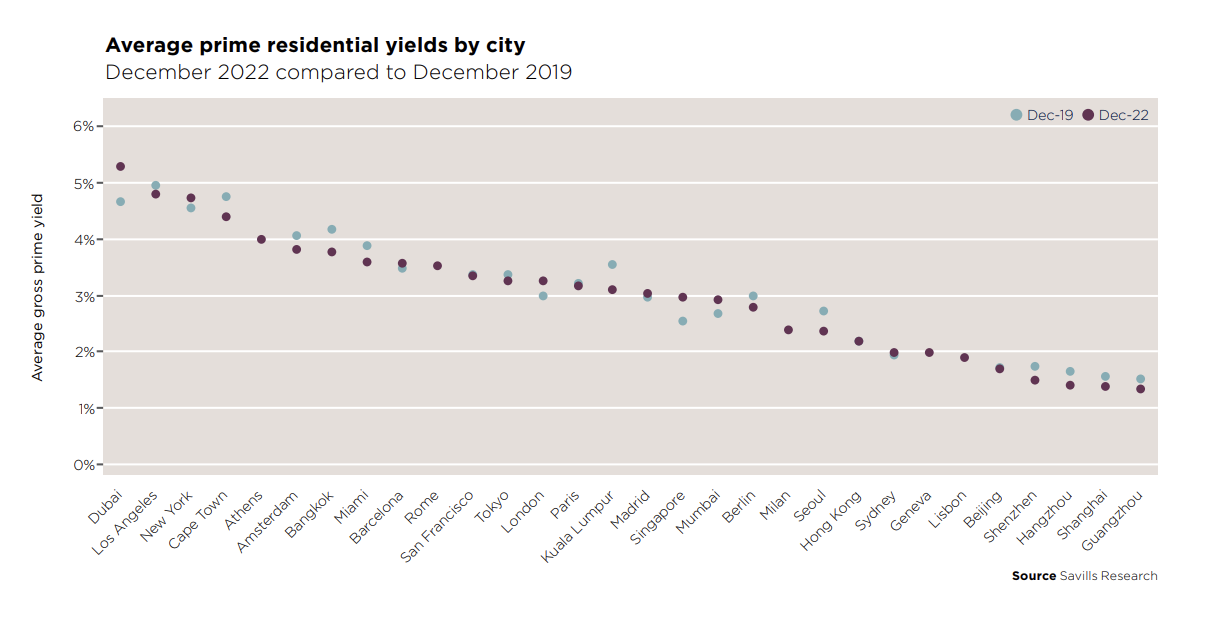

Best placed among the Southern European cities is Athens, which ranks 5th globally in terms of rental yield for high-end residential properties, reaching 4% in December 2022, just behind Dubai's yields , Los Angeles, New York and Cape Town.

Dubai and Singapore are forecast to lead global prime residential price growth

The regional hubs of Dubai and Singapore are forecast to lead global prime residential price growth in 2023. Both cities will continue to benefit from sustained inflows of high-net-worth individuals, but are not immune to higher interest rates and wider economic headwinds.

Dubai’s forecast prime price growth of between 6% and 7.9% in 2023, for example, is lower than the 12.4% growth it recorded in 2022. However, Singapore’s predicted prime capital value growth of between 6% and 7.9%, driven by a lack of supply at the top end of the market, is keeping pace with the 6.8% growth it recorded last year.

Major global hubs benefitted

Major global hubs benefitted in the wake of the pandemic, as borders reopened and demand for city living returned, but many will be unable to sustain this in 2023. Suffering from weaker sentiment associated with higher interest rates and the challenging economic backdrop, the prime residential markets of New York, San Francisco, Los Angeles, Seoul, Amsterdam, Berlin, London, Sydney and Hong Kong are all forecast to decline this year.

However, a general shortage of stock will put a limit to any more significant falls in value. Slowing tech and business services sectors will compound macroeconomic factors for San Francisco (-5.9% to -4%in 2023) and New York (-3.9% to -2% in 2023). While Seoul and London will see falls, they will be more modest than those expected in their mainstream markets due to a shortage of prime supply.