According to data from Danos, a member of the BNP Paribas RE group, investments in the real estate sector reached €133.2 billion, which is a 51% decrease compared to 2022. Several countries experienced a sharp decline, such as Germany (-57%), the Netherlands (-66%), Belgium (-74%), Ireland (-66%), Finland (-63%), Poland (-65%), and Denmark (-58%). Meanwhile, the reductions in Austria (-7%) and Luxembourg (-35%) were of a lower magnitude.

In Greece, investments reached €800 million. With regards to yields, 2023 will be considered, according to analysts, a year of "decompression" of returns in the European markets in all types of assets.

Office markets

2023 will be regarded as the year of yield

decompression with European markets

characterized by protracted price

discovery processes across all asset

types. Prolonged price discovery reflects the

similarly protracted nature of monetary

policy. It has taken the whole of 2023 for

central banks to get on top of persistent

inflation. Instead of ending the interest

rate tightening cycle in early 2023 as

many hoped, central banks maintained

the tightening process into the third

quarter.

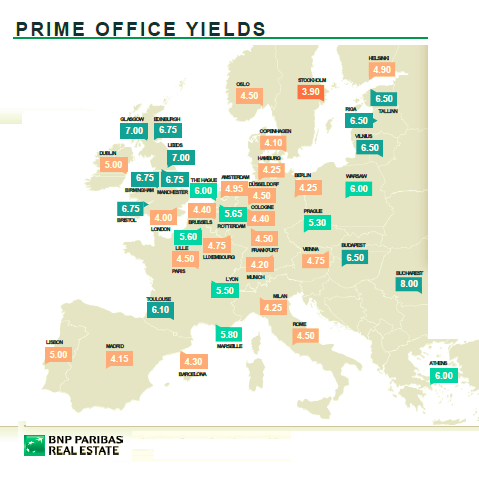

Universal decompression in office yields decame a feature in Europe in the fourth quarter of 2023. Strongest decompresssion in the last 12 months occured in the German markets, Paris, Amsterdam and Warsaw.

In Greece, the yields in the fourth quarter of 2023 compared to the corresponding period of 2022 reached 6%.

During 2023 there was 7.60 m sqm transacted in Europe’s 17 main markets over 2023, down by 19% vs 2022. Most European markets experienced significant declines in volumes including Dublin (-50%), Central London (-23%), Barcelona (-18%) and the six main German markets (-26%). Madrid (-1%), Brussels (+9%) and Rome (+78%) stand in contrast with some stabilization or even acceleration.

The overall vacancy rate in Europe stood at 8.0% at Q4 2023 (+40bp vs. Q4 2022). Expansion is the consequence of a growing geographical mismatch in supply and demand. Low availability in central submarkets and in new buildings secures demand. Much higher vacancy rates though are found in peripheral office districts.

Trends vary between markets: Munich, Frankfurt, Central Paris and Berlin saw a significant rise (100 bp or higher). Central London and Amsterdam experienced moderate increases. In Milan and Warsaw, the vacancy rate markedly declined.

The very low availability of prime assets and the appeal of highquality buildings located in the most sought-after districts continue to drive values up.

Workplace plays a key role in attracting and retaining talent, both in terms of space quality and location. Over the past 12 months, Amsterdam (+8%), Central Paris, Central London and Warsaw (+7%) have seen the most significant increases in values.

In Athens, prices ranged between €300 and €400 per sqm, and in particular at €372.