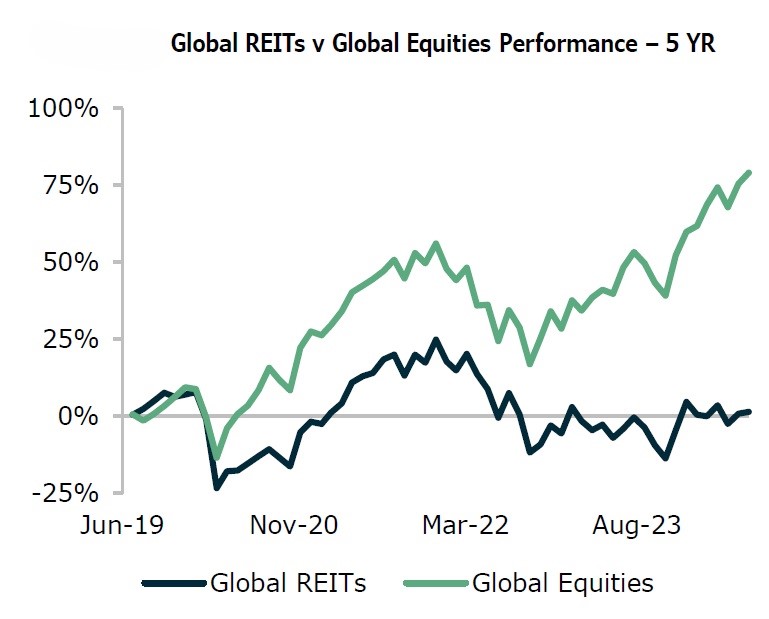

According to a Hazelview recently unveiled report global REITs have significantly underperformed compared to other assets like global equities. This divergence in performance can be attributed to several key factors that have created a challenging environment for REITs.

The COVID-19 pandemic had a profound impact on the real estate sector. The post-pandemic economic recovery has been marked by a rapid increase in interest rates starting in 2022. Furthermore, higher interest rates have made fixed-income investments more attractive, prompting investors to shift capital away from REITs in favor of higher-yielding alternatives.

However, as the macroeconomic environment

begins to shift, depressed REIT prices, along with potential rate cuts, present

a considerable opportunity for investors.

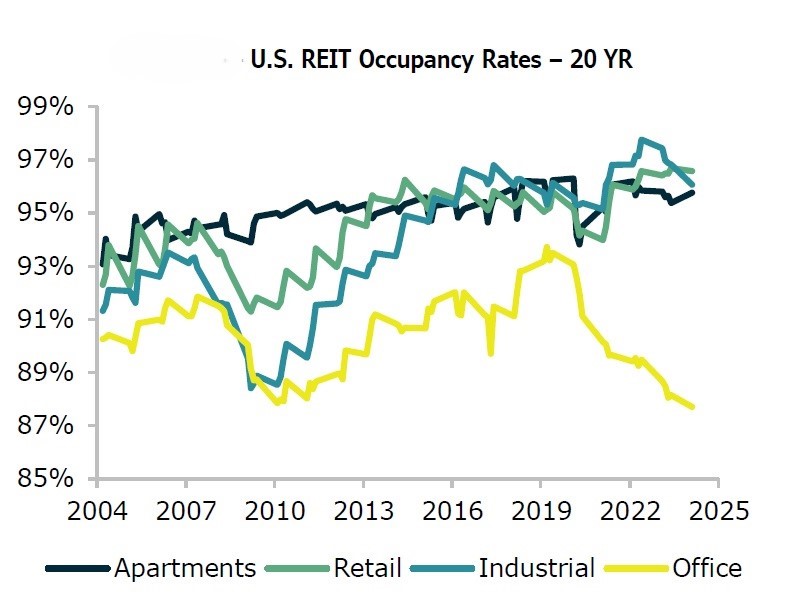

Demand fundamentals by sector

According to recent data from

NAREIT, industrial, apartment, and retail REITs in the U.S. have consistently

exceeded 95% occupancy rates, underscoring considerable strength and stability

in these markets.

Outside of traditional real estate sectors, specialty sectors like healthcare and data centers are noteworthy for their demand/supply dynamics. In the senior housing healthcare space, the growing need for senior housing is driven by the aging baby boomer population.

Additionally, technology REITs, such as data centers, are experiencing secular growth trends with the adoption of AI, significantly increasing demand. In Q1 2024, total data center leasing volume in North America set a record with over 1,800 MW of new leasing activity.

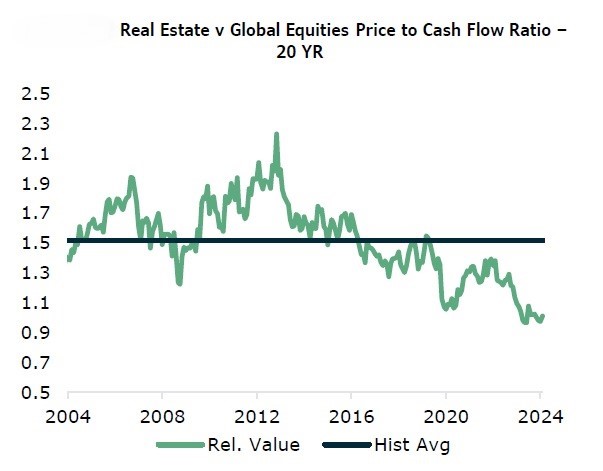

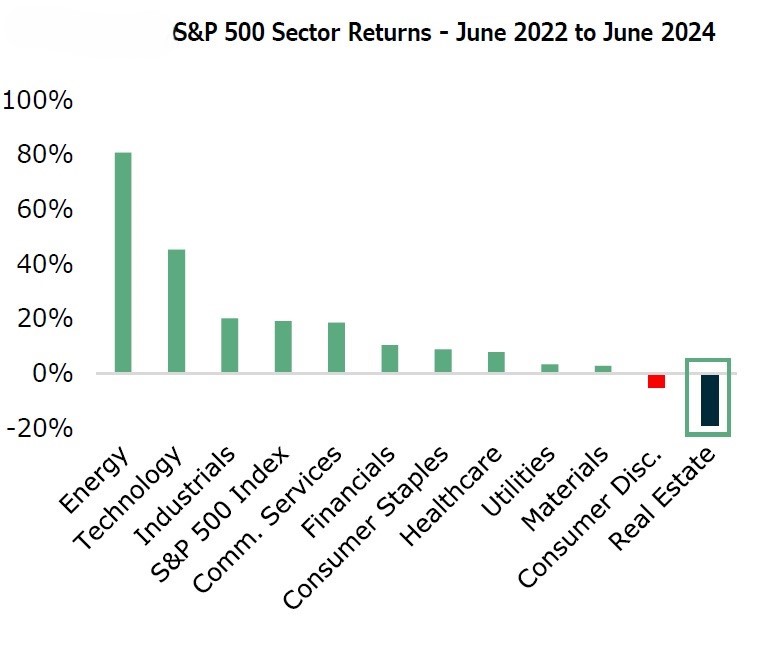

Discounted Valuations

One of the most compelling

reasons to consider REITs right now is the historically low valuation multiples

at which they are currently trading compared to equities. Since the start of

2022 to June 2024, REITs have experienced a contraction in their trading

multiple of around 30%, surpassing declines observed in any other industry.

According to UBS’s calculations the relative value spread of price-to-cash flow of real estate versus global equities over the past 20 years has a historical average of 1.5. Currently, that spread has narrowed to just 1.0, illustrating that REITs are trading at their cheapest levels in the past two decades relative to equities on a cash flow-to-price basis.

Considering that REITs have never been cheaper on a price-to-cash flow basis relative to equities over the past 20 years, this could signal a potentially lucrative entry point for investors. The current valuation discount offers the potential for significant upside as the market re-rates REITs to more normalized levels.

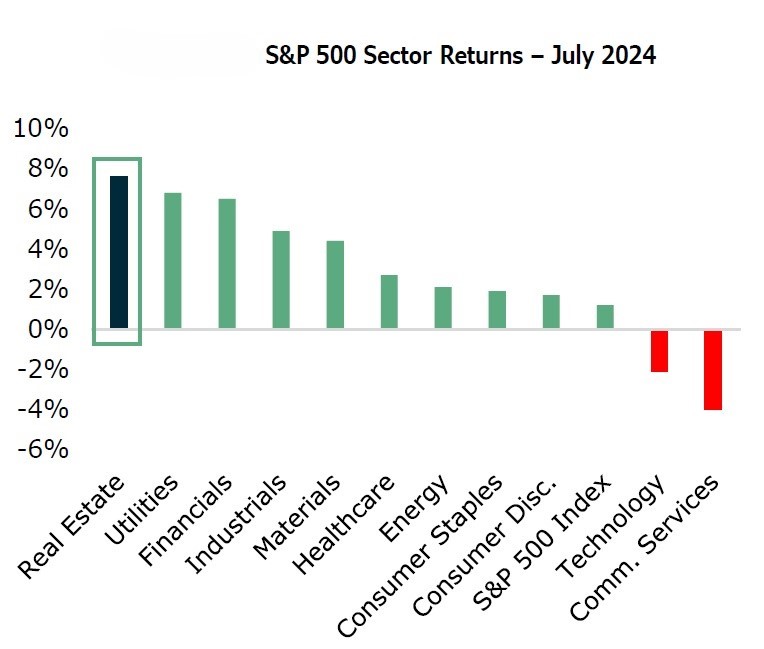

Signs of a possible bottoming in REITs

According to Hazelview there are signs of a possible bottoming in REITs as investors anticipate a rebound and move back into the space ahead of the expected Fed rate cuts. While there is always the potential that this may be another false dawn, it could also indicate the beginning of a reversal in investor sentiment towards REITs and a rotation back into the space.

As the macroeconomic environment continues to evolve, the potential for an improvement in asset values from a moderation in interest rates is likely to boost the sector.

An inflection point for REITs

While REITs have faced challenges over the past

few years, healthy fundamentals, current low valuation multiples and a more

favorable capital markets and macroeconomic outlook present a compelling case

for investing in REITs right now, Hazelview concludes in their report.

The overall tailwinds for real estate and

recent activity we are seeing in the market may finally signal an inflection

point for REITs. This combination of factors makes it an opportune moment for

investors to consider allocating to this asset class.

(source:Hazelview )