According to a BNP Paribas RE recently unveiled report, approximately 1.80 million square meters were traded. in office space in Q1 2023 in the 17 main European markets, down 22% compared to Q1 2022. And in volume, the period under review is down 15% from the 10-year average. According to analysts, take-up fell in several markets, including Dublin (-42%), Central Paris (-36%), Warsaw (-36%) and six German cities (-24%). At the same time Rome and Amsterdam are on the opposite trajectory with a rise of 70% and 34% respectively.

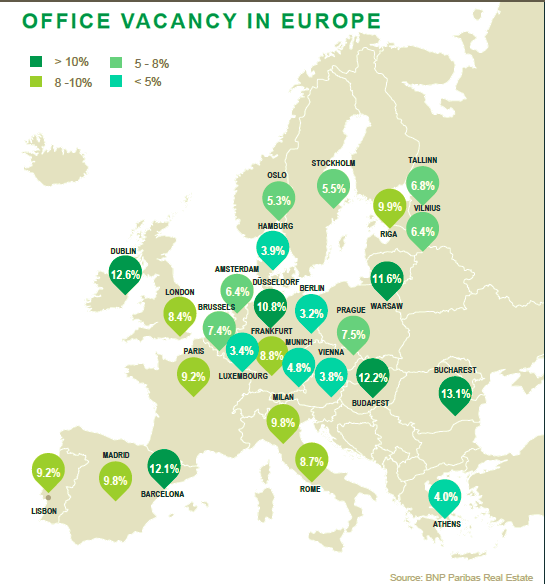

According to BNP's report, the overall vacancy rate for office properties in Europe stood at 7.4% in the first quarter of 2023 (+20 bp) compared to the first quarter of 2022. Most markets are stable, although vacancies increased in Barcelona (+300 bp vs Q1 2022) and Dublin (+210 bp). Most markets exhibit two-speed dynamics, with low availability in central submarkets and new buildings and much higher vacancy rates in peripheral office areas.

Rising office rents

Have been struggling to maintain their levels during the pandemic, office rents in key cities are now rising again.

With the widespread adoption of hybrid work models, companies are looking for attractive purpose-built workplaces that offer greater connectivity. Analysts say the very low availability of quality assets and the attractiveness of Grade A buildings located in the most sought-after areas are driving values up. More specifically, in the last 12 months, London recorded an increase of 21%, Milan 10%, Warsaw and Dublin 8%.

Greece and the lack of modern quality office spaces

The lack of modern quality office spaces is the most important issue of the domestic office market according to industry players. At the same time, companies choose to proceed with the remodeling of older facilities and their transformation into a category A product. "The office market in general moves at different paces depending on the quality characteristics of the property" was the key message of representatives of the Greek REIC during the 16th RED Business Point. They said that modern companies are mainly looking for "green" buildings and investors are interested in sustainable real estate portfolios. The percentage of vacant office space hovers around 7.45%, while the rental price for prime office buildings per square meter exceeds €25 per month.

"The existing stock is of very poor quality, so something must be done" said Ms. Jenny Mourousia, CIO of Noval Property. While as characteristically mentioned by Ms. Teresa Messari CFO, COO of Prodea Investment "the REIC are forced to become developers as well or in collaboration with the few real estate development companies that exist to create a product with sustainability criteria that is able to attract big names of domestic and foreign businesses". Mr. Errikos Arones CEO of Hellenic Properties stated during the 16th RED Meeting Point that "tenants are divided into two categories, those who can pay ESG in building infrastructure and those who cannot . Some have crossed over to the other side, it is necessary for them to rent a building. They continue to demote it as a feature and they will not be able to escape from this train."