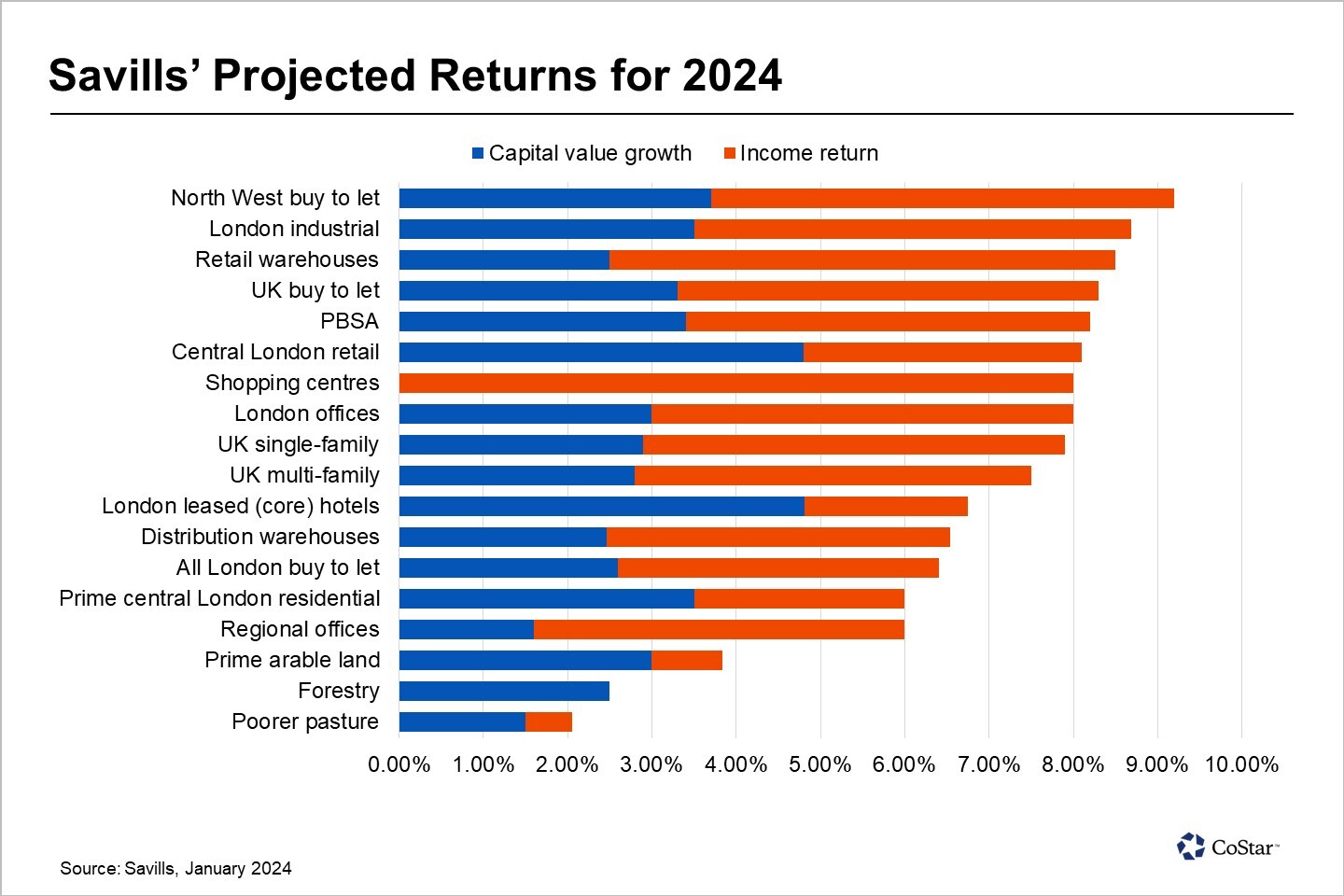

According to the global consultancy, the BTR (buy to rent) category in the North West, industrial properties, and London retail warehouses will provide annualized returns ranging from 8.5% to 9.2% between 2024-2028. The consultancy's annual forecasts indicate a stronger outlook and more opportunities for property investment in the UK by 2024, with stable interest rates.

In commercial real estate, the retail, industrial, and office sectors are currently priced attractively, presenting a buying opportunity.

Savills expects that in 2024, opportunistic investors will target certain parts of the retail market due to revised rents, interest rates and higher yields. Additionally, demand for high-end warehouses is also set to increase, keeping prices on the rise in London.

While the UK office market has been uneven in the past year, Savills highlights that lower inflation, falling borrowing costs, and good rental growth prospects will make development programs more viable in 2024. Investors will attempt to capitalize on the insufficient supply of high-quality and green office space.

Savills further notes that in 2024, investors will shift their focus from making sector-wide announcements to traditional asset fundamentals.

It is a known fact that there is still a shortage of high-quality prime and green office spaces in major UK markets. This situation is expected to continue and will drive the average rent growth in the short to medium term. According to analysts, there is no expectation of an increase in retail investment volumes until 2024.