Despite the economic challenges, the markets for prime residential properties exhibited positive performance, while rental markets capitalized on sustained demand and limited supply. Approximately 70% of the 30 cities monitored in the Savills "WORLD CITIES PRIME RESIDENTIAL Index" saw positive growth in property values. This reflects the continued resilience of the prime property market despite the ongoing challenges. The index tracks the top 5% to 10% of prime residential property prices in thirty global cities, based on a consistent sample of properties in each location.

The prime residential markets in 2024 delivered a positive performance, with capital values increasing by 1.3% from July to December, adding to the 1.2% rise recorded at the start of the year, bringing the total growth to 2.2%. While this growth did not reach the levels observed post-pandemic, it remains impressive, particularly given the uncertainty prevailing in many markets.

However, 2025 is expected to be a more subdued year for the global real estate market. While capital values are forecasted to rise by 1.6% globally, this growth is lower compared to 2024, with policies and international geopolitical developments expected to play a significant role in shaping the market.

Among the 30 cities on the index, the most expensive city is Hong Kong, with €38,000 per square meter, followed by New York at €25,500 per square meter, Geneva at €25,200 per square meter, Tokyo at €20,900 per square meter, and Shanghai at €19,700 per square meter. Athens ranks 22nd, with €11,600 per square meter, surpassing several European cities such as Berlin, Madrid, Barcelona, and Amsterdam.

Certain markets are expected to experience negative growth in property values due to restrictive measures aimed at curbing demand, such as tax increases and restrictions on foreign buyers. In the United Kingdom, for example, the removal of the "non-dom" status and the imposition of an additional 2% tax are anticipated to result in a decline of approximately 2% in property prices in London in 2025.

Double-Digit Growth in Rental Prices

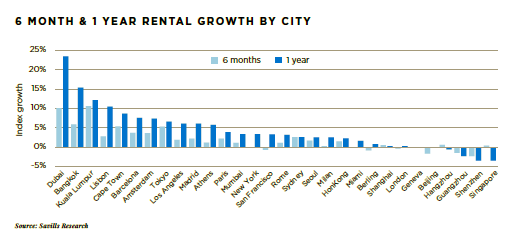

In contrast to the declines in sales prices, the rental market remained strong in 2024. Despite high demand, tenants seem to prefer renting prime properties for longer periods, as high property prices and elevated loan interest rates make purchasing property increasingly challenging. The demand for top-tier rental properties from high-income residents and business professionals, combined with limited supply, supported the strength of the rental market in many cities.

Rental yields increased most rapidly in Dubai and Kuala Lumpur, with growth rates of 5.3% and 4.3%, respectively, driven by strong demand and limited availability. Other cities showing high rental yield growth include New York, Cape Town, and Amsterdam, all of which saw significant increases in rental prices in 2024. The high yields in these markets are expected to continue into 2025, with the rental market likely to outperform the sales market.

Forecast for 2025: Stability and Gradual Recovery

For 2025, forecasts for the rental market indicate moderate increases, with rental prices expected to rise steadily across the 30 cities monitored in the index. Demand for rental properties remains strong in most cities, driven by both foreign and local tenants.

The availability of more options, combined with ongoing uncertainty and economic challenges, continues to shape the trajectory of the real estate market, affecting both sales and rental markets.