The retail sector not only demonstrates remarkable resilience year after year, but also proves its ability to adapt and evolve in response to changing macroeconomic conditions and customer requirements. In Cushman & Wakefield's 34th edition of Main Streets Across the World, the central themes are “flexibility” and “strength,” highlighting how retailers are rising to the challenge and positioning themselves for future growth.

Despite recent challenges, retailers across the world remain committed to the strength of having a physical retail presence in super-prime destinations as evidenced by the ongoing levels of extremely tight vacancy rates.

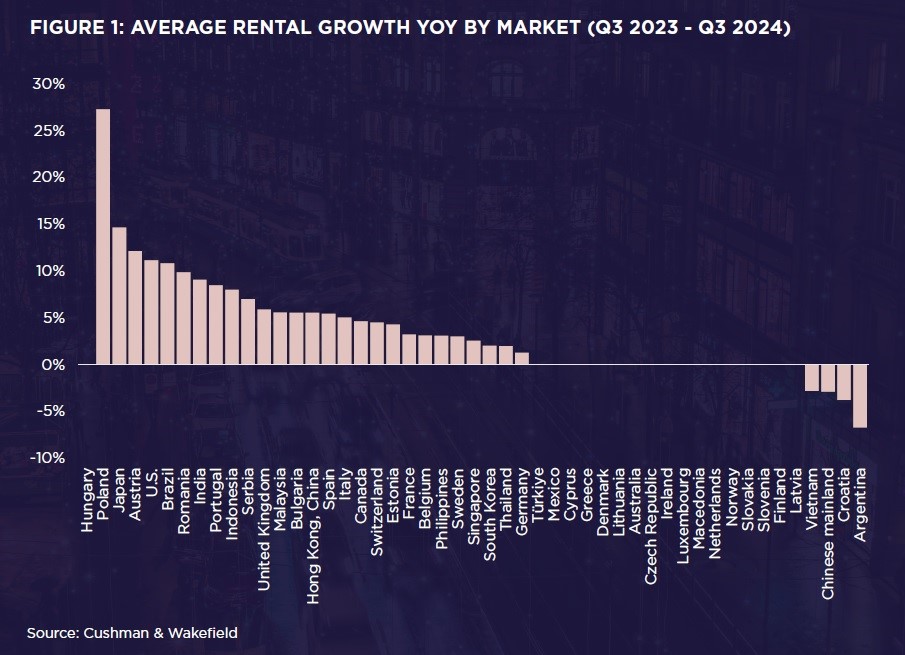

In light of current economic conditions, retailers have needed to balance cost pressures with evolving consumer loyalty preferences. Due to the pace of change, brands have needed to be agile and to adopt a data-first approach to drive innovation and remain profitable. At the same time, retailers beyond luxury brands are also increasingly recognising the benefits of super-prime retail streets. This shift has led to the growth of sports, cosmetics and wellness brands competing for space. As a result of this competitive tension for limited space, year-over-year (YOY) rental growth has occurred in over half of the 138 locations tracked, with some showing significant growth.

According to the report, rents across the 138 locations tracked have crossed another benchmark – now being on average nearly 6% above pre-pandemic levels, thanks to strong rental growth of over 4% YOY. Globally, 57% (79) of locations experienced positive rental growth, with just 14% (19) registering rental decline. The remaining 29% (40) were stable YOY.

Beneath this global average, the Americas continues to be the strongest performing region, propelled by rent growth of almost 11% YOY in the U.S. – a significant increase from last year. In comparison, rent growth in Europe and Asia Pacific slowed, registering growth of 3.5% and 3.1%, down from 4.2% and 5.3%, respectively.

Europe’s first time at the top in report history

Milan’s Via Montenapoleone overtook New York City’s Fifth Avenue as the world’s most expensive retail destination; the change marks Europe’s first time at the top in Cushman & Wakefield's "Main Streets Across the World 2024, 34th Edition" report history. This reflects robust rental growth on the Italian street, exceeding 30% in the last two years, further bolstered this year by the euro’s appreciation against the U.S. dollar.

Further changes occurred in position three, with London’s New Bond Street leapfrogging Tsim Sha Tsui in Hong Kong, pushing the latter into 4th spot despite positive rental growth this year. Avenue des Champs-Elysees in Paris retained 5th position, but the gap to 6th narrowed following 25% YOY rental growth in Tokyo’s Ginza district.

Athens, Greece, ranks 25th on the list of Europe’s most expensive retail streets for 2024, holding steady in the same position as the previous year.

Rents on average now sitting above pre-pandemic levels

As the world digested the impacts of a steep rise in interest rates, starting in 2022, prime retail destinations have for the most part successfully weathered the storm. Importantly, the world crossed another significant benchmark with rents on average now sitting above pre-pandemic levels.

This feat had long been achieved in the U.S., but Asia Pacific has now crossed this mark and Europe continues to eat away at the deficit. Together, this has resulted in rents now being on average almost 6% higher than before the onset of the pandemic. In numerical terms, 72 (52%) locations are at or above pre pandemic levels, while 66 (48%) are still yet to fully recover.

In Europe

While overall rental growth was relatively modest, there were a few standout locations that recorded robust growth over the year. Váci Utca in Budapest led the region, with rents growing 27% YOY (though it is noted that this was off a relatively low base as the city ranked 29th overall), driven by strong retailer demand in an environment of constrained supply. More meaningful growth in absolute terms was experienced in London’s Regent Street and New Bond Street, where rents grew 16% and 13%, respectively, which equates to a $300 (USD) increase in the case of New Bond Street.

Outside of this, positive rental growth was experienced across many locations in Western and Southern Europe, reflective of the strong tourism inflows not only associated with this being an Olympics year but also ongoing strong demand from U.S.-based tourists. Only two out of the 57 locations tracked in Europe recorded rental decline in the year: Kalku Street in Riga (-3%) and Ilica Street in Zagreb (-7%).