In response to the scarcity of private market capital globally, Gulf investors are calling for a deeper link through investment schemes (GPs) to comprise more opportunities for co-investment and access to know-how. And they are aparently willing to pay much for it.

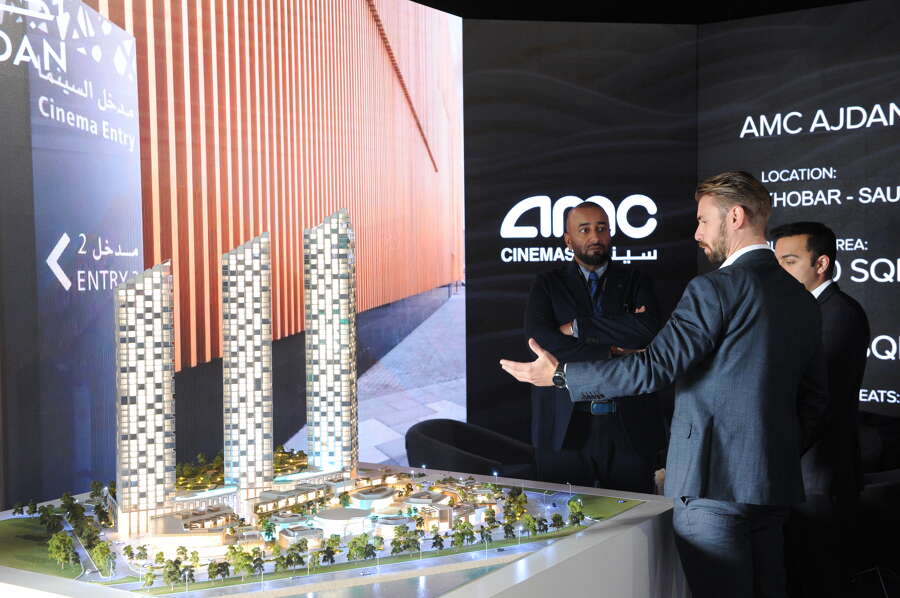

Both the Emirates and, above all, Saudi Arabia, are focused on trying to implement their ambitious plans to move their economy away from oil, so that the ambitious Vision 2030 plan becomes a reality.

The primary goal is to be committed with domestic entrepreneurship. This is evident from the signed agreements which have increased significantly, from just 19 in 2018 to 118 last year. And they're trending up.

On the side of investments, in January, the $2 trillion oil giant Aramco has more than doubled Aramco Ventures funding to $7.5 billion to develop strategic technologies. On the transaction side, in December promising Riyadh-based fintech Tamara raised $340 million in a Series C funding round led by SNB Capital and Sanabil Investments.

However, supporting start-ups is only one piece of the puzzle.

Saudi Arabia needs $3 trillion investment, according to estimates by the US State Department, to become oil independent.

Investments in RES and Data Centers are part of this framework -in this context was also the acquisition of TERNA ENERGY that was sealed recently as well as participation in the implementation of Regional Data Centers.

Nevertheless, the challenge is to have the figures add up.

The National Investment Arm targets annual foreign direct investment (FDI) of $103 billion and domestic capital investment of $450 billion by the end of the decade.

According to Jamil IHallak, Chief Investment Officer of Othaim, private funds should aim for the active participation of family offices. Just to developing offices is considered insufficient. Real engagement should include knowledge transfer, infrastructure development and co-investment.