On the other hand, African countries account for only 4% and Latin America for only 3% of the countries that multinational companies choose to avoid taxing their profits. Among the countries that performed worse than before are Brazil, Poland and Mexico.

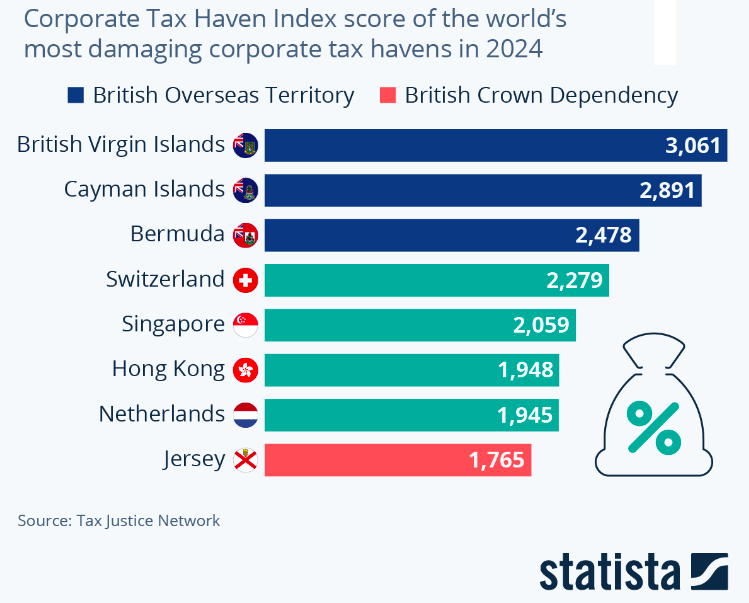

Ireland entered the top ten list for the first time in 2024 with an index value of 1,622, ranking ninth. It is followed by Luxembourg (1,480) and then the Bahamas, the latter of which is an independent member of the British Commonwealth.

In 12th place comes the Isle of Man and in 13th Guernsey, both Crown Dependencies. The United Kingdom is in 18th place with a value of 894.

The indicator assesses laws and tracks the volume of corporate financial activity. The Haven score is determined by more than 70 questions under 18 indicators to find the extent to which a state's laws and regulations allow corporate tax abuse. The output of these indicators is then combined with global weighting factors, which are based on IMF data on foreign direct investment. The final figure is a measure of each scheme's contribution to the global problem of corporate tax abuse.

source: www.statista.com