The pandemic, coupled with the subsequent resurgence of inflation, has triggered the most severe housing affordability crisis in over a decade. Housing affordability has significantly declined in several countries, including the United States, the United Kingdom, Australia, Canada, Germany, Portugal, and Switzerland. According to recent data from the International Monetary Fund (IMF), housing is now less affordable on average across these nations than it was during the housing price "bubble" that preceded the 2007–2008 global financial crisis.

As a result, housing has risen to the top of household concerns globally, surpassing healthcare and education, according to recent surveys (Romei and Fleming, 2024). This issue has become a central focus for policymakers worldwide, as housing plays a crucial role in economic stability. Unlike other assets, the housing sector carries a social dimension, with homeownership often seen as both a fundamental right and an investment. The speculative nature of the market has contributed to price increases, further exacerbating affordability challenges.

The crisis is also a reflection of higher borrowing costs, as central banks have raised interest rates to tackle inflation. At the same time, housing shortages, combined with strong demand driven by robust household formation, have kept property prices elevated.Measuring Housing Affordability

Housing affordability is a critical yet nuanced concept, particularly when comparing countries with vastly different housing markets and financing structures. As highlighted by the IMF, traditional indicators of affordability have primarily focused on relative housing costs, such as the price-to-income ratio or the share of income spent on housing. While these measures provide useful insights, they do not fully account for the dynamics of the housing market or the specific characteristics of typical homes.

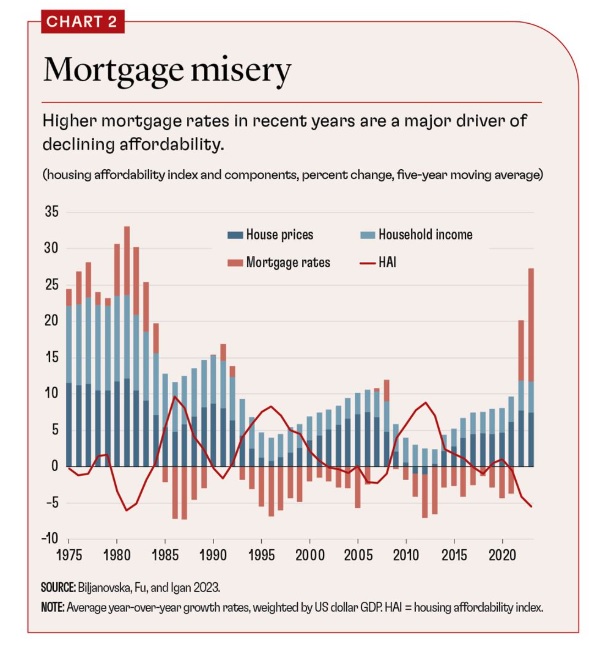

A more refined approach to measuring affordability looks at a household’s ability to make regular mortgage payments on a typical property occupied by a standard-sized family, without undermining other essential needs. Specifically, the Housing Affordability Index (HAI) assesses the ratio of real household income to the income required to qualify for a typical mortgage. This method offers a more comprehensive view of affordability, complementing traditional measures. An HAI above 100 indicates that housing is more affordable, while a lower index signals a decline in affordability.

Post-Pandemic Crisis

Over the past 50 years, the IMF has calculated the HAI for 40 countries. A key observation is the sudden decline in affordability over the past two years. In the United States, for instance, housing affordability fell from around 150 in 2021 to the mid-80s by 2024. In the United Kingdom, the affordability index dropped from 105 in 2021 to the low 70s by 2024.

Similar declines have been seen in Austria, Canada, Hungary, Poland, Portugal, Turkey, and the Baltic states. This sharp reversal follows a period of improving affordability in recent decades, and, much like the surge in inflation, has had a profound psychological impact on many households.

The Cause of the Decline

The housing affordability crisis was exacerbated by the COVID-19 pandemic. During the recession, house prices rose unexpectedly in many countries—an anomaly compared to past economic downturns, when housing markets typically softened. Several factors contributed to this rise, including supply chain disruptions, lockdown-induced construction delays, and government stimulus programs that boosted demand.

As central banks globally began raising interest rates to curb inflation, many market participants anticipated a correction in house prices. While prices did decline to some extent, they fell far less than expected, even as mortgage rates increased. This situation has contributed to the ongoing affordability challenges, prompting a reevaluation of housing market trends and their drivers.

Affordability Trends Over Time

Housing affordability has been in a steady decline over the past half-century. From the 1970s to the mid-1990s, the average affordability index was consistently below 100, signaling poor affordability. However, by the late 1990s, the affordability index improved, surpassing 100 and remaining above that threshold for several years. The period following the global financial crisis saw further improvements in affordability, which persisted until the pandemic’s aftermath, when affordability sharply deteriorated.

This historical perspective highlights the cyclical nature of housing affordability and underscores the role of both macroeconomic factors—such as interest rates and inflation—and structural elements, including supply and demand dynamics, in shaping the housing market.

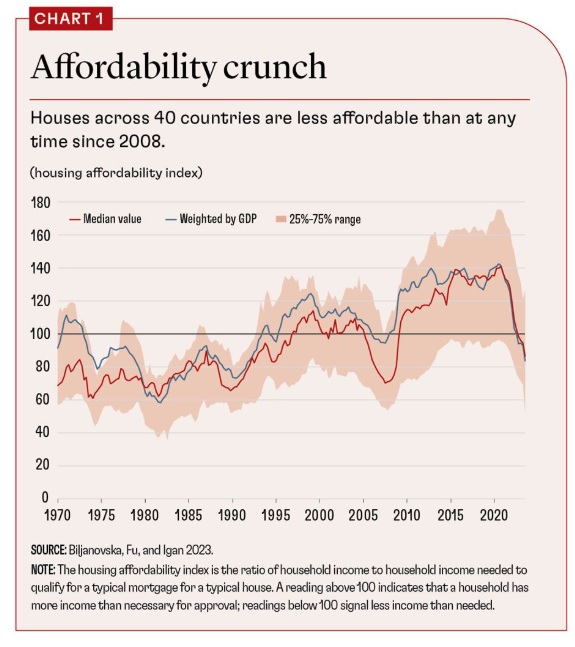

The drivers behind the trends in housing affordability are primarily the time-varying components of the Housing Affordability Index: nominal mortgage rates, household income, and house prices. In the mid-1970s and early 1980s, affordability worsened as both house prices and borrowing rates rose, while household incomes did not keep pace.

During the global financial crisis, house prices initially declined, but as central banks implemented low long-term interest rates to stimulate struggling economies, house prices slowly recovered. The combination of lower borrowing costs and reduced house prices during this period improved affordability for many households.

However, the COVID-19 pandemic reversed this trend. Initially, house prices rose sharply due to increased demand and supply constraints, and then, as central banks raised interest rates to combat inflation, mortgage rates also climbed. This double effect led to a significant decline in affordability.

While this broad analysis provides valuable insights, it has some limitations. The Housing Affordability Index primarily reflects affordability from the perspective of a prospective homeowner who is looking to finance a property with a mortgage, making interest rates a critical factor. However, this measure does not capture affordability in other contexts, such as for individuals who own their homes outright without a mortgage, or for renters. Additionally, by focusing on the average household, the index overlooks significant differences across income distributions and between generations, which can result in varying levels of affordability depending on specific circumstances.