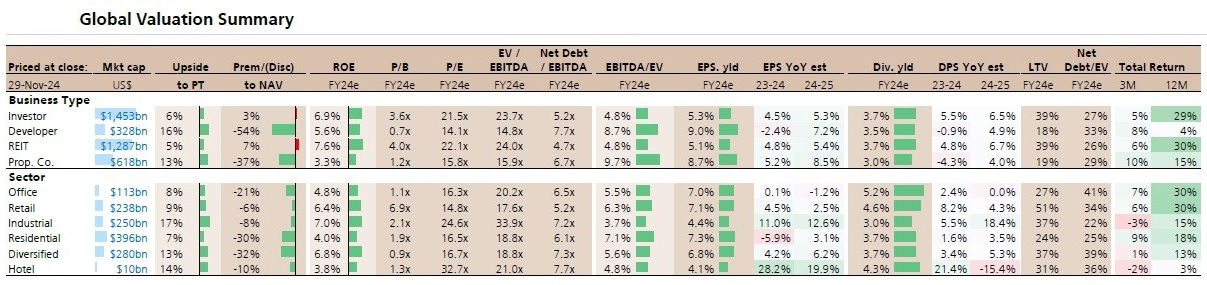

On the other hand, developers offer a much more significant upside of 16%, but they trade at a steep discount to their net asset value (NAV), which stands at -54%. Their P/E ratio is more attractive at 14.1x, yet earnings growth in the near term is negative, with an expected YoY decline of -2.4%, which highlights the current challenges in the development sector.

According to UBS’s recently released Global Real Estate Valuation Sheet, which covers over 200 real estate companies, REITs offer a modest upside of 5%, paired with a solid dividend yield of 3.7%. REITs are particularly notable for their low Net Debt/EBITDA ratio of 4.7x, reflecting a more mature business model that is less reliant on leverage, making them an appealing choice for income-focused investors.

Property companies show a decent upside of 13%, accompanied by a relatively high EPS yield of 8.7%. However, while their expected growth is slightly more subdued, they carry a higher degree of leverage, with a Net Debt/EV ratio of 4.0%, which could raise concerns among more risk-averse investors.

Sector performance

In terms of sector performance, the industrial sector stands out with a strong upside potential of 17%, bolstered by robust earnings growth of 12.6% YoY from 2024 to 2025. Despite a relatively high P/E ratio of 24.6x, the sector's growth prospects make it an attractive investment choice for those seeking higher returns, albeit with more volatility.

In contrast, the residential sector is expected to grow at a slower pace, offering just a 7% upside. It has a modest ROE of 4.0% and a high P/E ratio of 16.5x, but its relatively stable dividend yield of 3.7% might still make it appealing to more conservative investors.

The diversified sector offers a reasonable upside of 13%, along with an EPS yield of 6.8%, which is attractive in a market searching for stable returns. However, this sector is trading at a substantial discount to NAV of -32%, potentially providing a value play for investors focused on distressed assets or undervalued opportunities.

The hotel sector, despite having a much smaller market cap of just $10 billion, provides a significant upside of 14% and a high dividend yield of 4.3%. However, the sector carries a relatively high P/E ratio of 32.7x, reflecting strong expectations for growth. This combination of high growth potential and high valuation makes the hotel sector a more speculative choice within the broader real estate market.

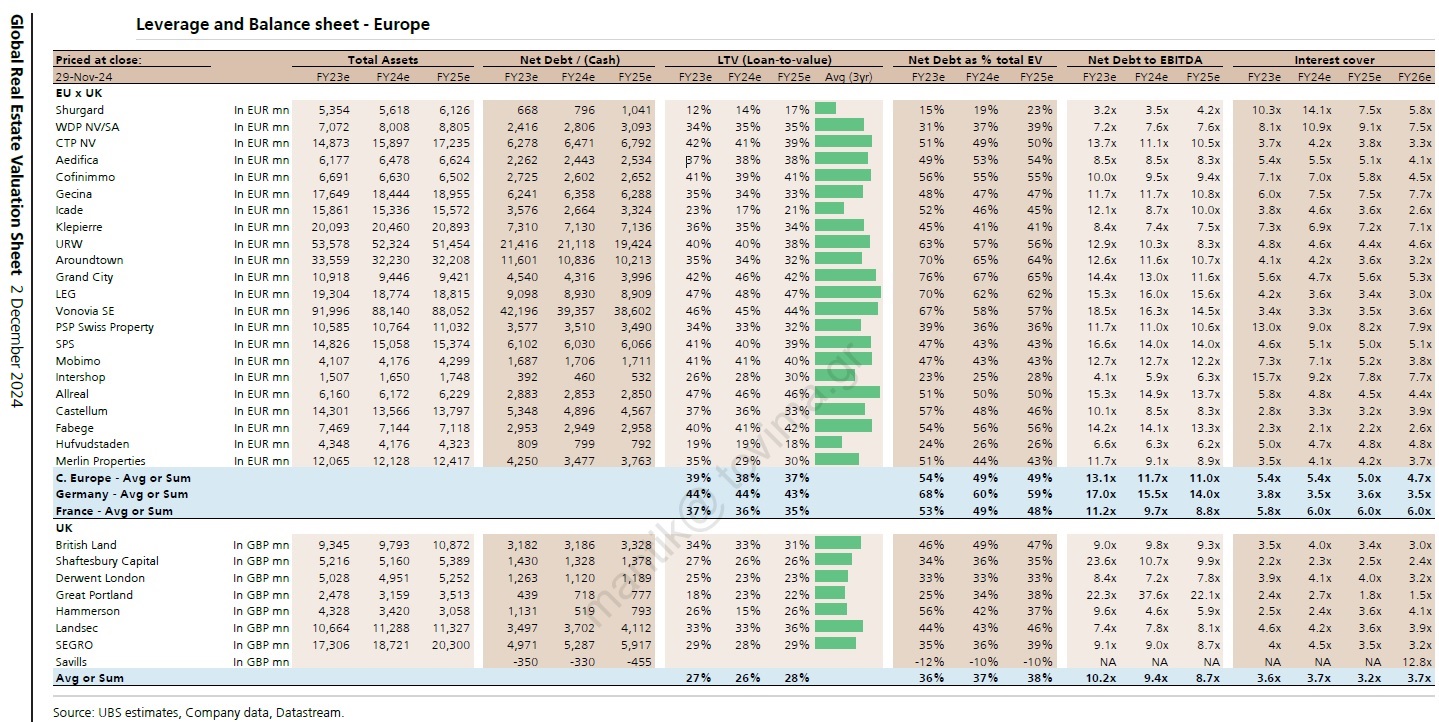

European real estate entities are taking a more cautious approach to debt

According to UBS, European real estate entities remain modestly leveraged, as demonstrated by their loan-to-value (LTV) ratios. For 2024, entities in Central Europe are expected to report an LTV of 38%, with a slight reduction of 1 percentage point anticipated in 2025, bringing the figure down to 37%. In Germany, the expected LTV for 2024 is 44%, and a similar reduction of 1 percentage point is forecast for 2025. In France, the LTV for 2024 is expected to be 36%, with a small drop to 35% in 2025. Meanwhile, in the UK, the LTV for 2024 is expected to be 26%, which is projected to increase slightly to 28% by 2025.

Overall, UBS anticipates that the leverage levels across these regions will continue to moderate slightly over the coming year. This suggests that European real estate entities are taking a more cautious approach to debt, likely reflecting broader market conditions and a desire for more stable financial positions.

Disclaimer: The information contained in this text is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities, financial instruments, or products. All investments involve risk, including the potential loss of principal. It is advisable to consult with a professional financial advisor, accountant, or legal counsel before making any investment decisions.