Nationwide Building Society said the average price of a home dropped 0.2% last month after 0.7% gains in each of the two previous months. Economists had expected a small increase on the month.

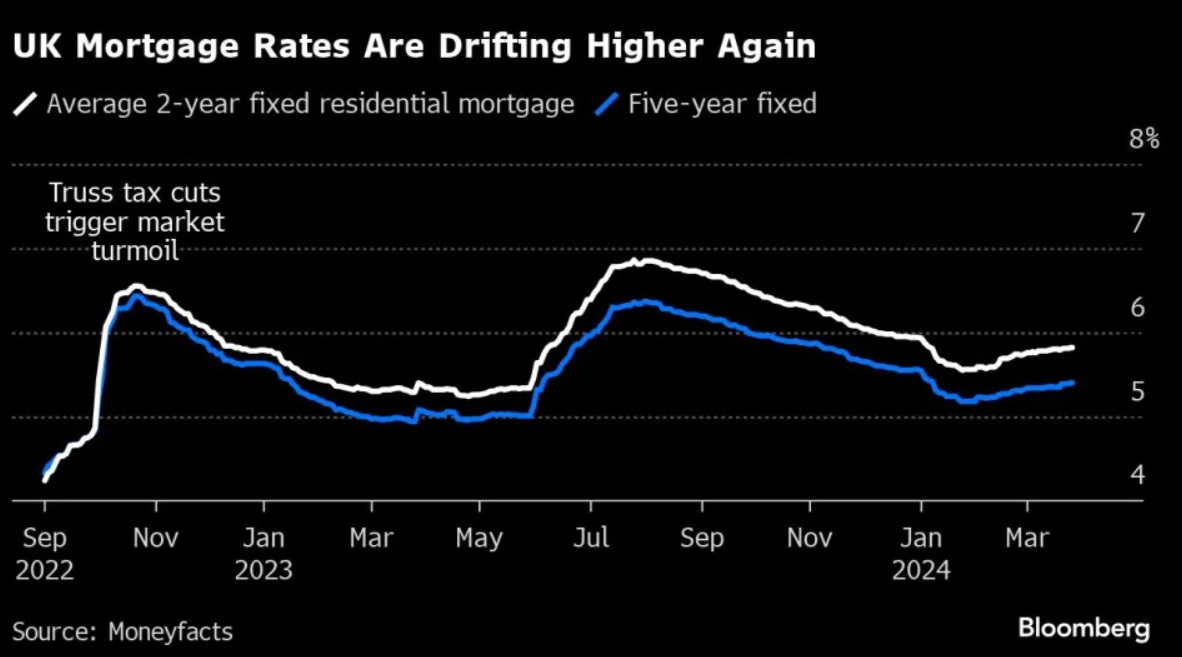

Britain’s property market has defied expectations for a sharp drop in prices last year, delivering modest gains since September when the Bank of England brought to a halt its quickest series of interest rate increases in decades. But prices remain at levels that many buyers find difficult to finance, especially with the benchmark lending rate at a 16-year high.

“Activity has picked up from the weak levels prevailing towards the end of 2023 but remain relatively subdued by historic standards,” Robert Gardner, Nationwide’s chief economist, said in a report Tuesday. “This largely reflects the impact of higher interest rates on affordability.”

The average cost of a home is now £261,142 ($327,590), according to Nationwide’s reading, which is the first of several indicators of the market due out this month. That’s 4.6% below the peak recorded in late 2022. Prices have now grown 1.6% from a year ago.