These new approaches are rooted in “unpacking”

ESG ratings using more granular information to reveal relative strengths,

weaknesses, risks, and opportunities across the investable universe.

So how do property investors “unpack” ESG

ratings from an organization like GRESB to support new investment strategies

and uncover new drivers of investment returns?

#1 Unpack to Create New Investment Strategies

The traditional approach to ESG management

suggests that higher scores equal better investments. This can be true.

Companies and funds with high GRESB scores, for example, are, by definition,

superior to their peers with respect to how they are managed and perform with

respect to environmental, social and governance issues. For context, a GRESB

rating is a composite of three high-level components (Management, Performance,

and Development) and an array of more granular aspects, including risk

assessment, targets, energy, greenhouse gas emissions, water, waste, and

building certifications (GRESB ESG Data & Metrics). Each element is

scored to provide a composite rating against peers and the broader industry.

Many investors use GRESB ratings to create and engage portfolios of

best-in-class companies and funds (e.g., all top-rated GRESB entities).

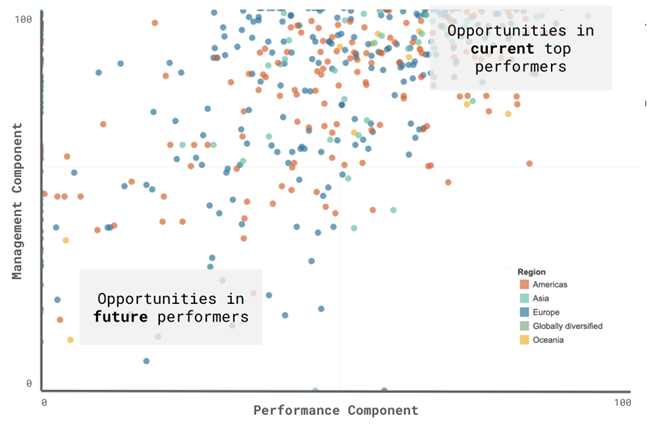

Investing in today’s best companies and funds encourages investors to search for opportunities in the “top right” of the GRESB management and performance universe – an elite group of currently high-performing companies and funds. However, there are many more ways to find investment opportunities in ESG space.

The essence of real estate is to create value

by investing for growth and positive impact. This might mean that investors

search for promising opportunities among the low-scoring companies in the “lower left” of the GRESB universe.

While these companies might be overlooked or even explicitly excluded using a

traditional ESG lens, by reporting to GRESB these currently low-scoring companies have provided a

level of transparency that creates more opportunities for investors. They can

use this information to identify opportunities to create value of the course of

an investment. Looking beyond the topline rating allows investors to find

actionable opportunities related to energy efficiency, water conservation,

waste management, stakeholder engagement, and other factors. Investors can use

this information to pursue a “brown discount” when acquiring the company and a

“green premium” when selling their investment (Addae-Dapaah and Wilkinson 2020).

Bottomline: Investors can unlock value by looking beyond the “upper right” of the GRESB universe, using sustainability as a strategy to reposition companies and capture superior returns.

Figure 1. Investment

strategies in the GRESB universe: (a) opportunities to invest in current top performers and (b)

opportunities to invest in future top

performers. (Chart is available here with the embedded chart here.) |

|

|

#2 Unpack to Find Drivers of Financial Returns

The traditional approach to ESG management

follows the logic that higher scores equal better investments. This has been

supported by a long history of econometric research.

For example, Cambridge researchers studied European listed property companies and found significant positive correlations between overall GRESB ratings and Return on Assets and Return on Equity (Carbon War Room 2015). Devine and colleagues (2022) presented more evidence of these relationships in an econometric study of private equity real estate. They found that GRESB participation and performance were significant predictors of cross-sectoral fund returns, including price appreciation.

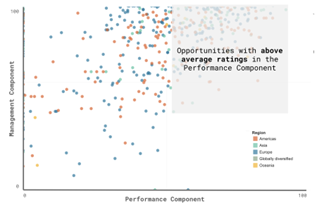

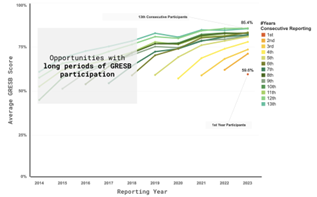

Recent research suggests that “unpacking” ESG information can help investors better understand the drivers of outperformance and find returns, even in mature markets. A 2023 study of private real estate conducted in partnership with INREV connected GRESB ESG ratings with financial returns for 163 non-listed European property companies (Brounen and van der Spek 2023). The study affirmed positive correlations between ESG performance and financial returns, showing a buy-and-hold return advantage of 1.8% per year when comparing GRESB participants to non-participants.

Digging deeper, the study’s authors controlled for a wide range of co-varying factors, including strategy, market cycle and experience. The results indicated that relatively mature European private companies showed minimal opportunities for differentiation through management and governance practices. Conversely, they found that higher total returns were correlated with superior scores on the GRESB Performance Component and environmental performance metrics.

This insight suggests new opportunities for

investors to “unpack” ESG ratings to focus on the qualities that best predict

returns in target markets. In the case of European non-listed companies, this

means prioritizing investments based on GRESB Performance Component scores and

key environmental metrics (e.g., energy efficiency, greenhouse gas emissions).

Predictors are likely to vary between markets and property types. Investors

will need to customize how they unpack ratings to find relevant relationships in

specific regions and markets.

Bottomline: Investors can “unpack” ESG ratings to find predictors of returns in specific market segments and circumstances.

Figure 2: Results from a study of 163 non-listed European funds show positive correlations between total returns and (a) entities with above average Performance Component ratings and (b) entities with long periods of participation. On average, firms with these characteristics have outperformed their peers. (Source: GRESB Public Results Dashboard) |

|

|

(a) |

(b) |

While global investors use ESG data in various

ways, many are going beyond the traditional engagement model to “unpack” ESG

ratings to support new investment strategies and find new predictors of

financial risk and return. This requires more nuanced and granular analyses of

the ESG data available. Done right, the reward can be new investment

opportunities, more predictable returns, and significant benefits for society

and the environment.

*This exclusive article from Mr. Chris Pyke, Ph.D., Chief Innovation Officer, GRESB BV (c.pyke@gresb.com) is part of RE&D Magazine's annual edition "New Rules of Engagement", available at this year's MIPIM 2024.