JLL, in its "Global Real Estate Perspective February 2024" expects continued volatility in 2024, although post-pandemic disruptions are moderating with signs of strengthening occupier demand and renewed momentum in capital markets. Economic growth is set to be below trend and historic rates in 2024, but as inflation eases further and policy rates are cut, the second half of the year looks stronger and momentum should build from there into 2025.

Signs of gradual recovery in demand for offices

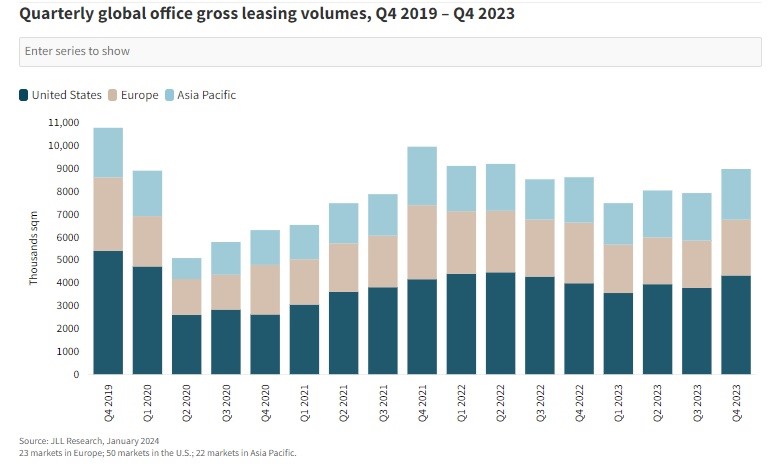

Following another year of transition for many office occupiers in 2023, there are signs of a gradual improvement in demand as interest rates peak and many companies reach an equilibrium in office attendance or advance their objectives in driving higher office utilization. According to JLL, global office leasing volumes in Q4 2023 increased by 13% from the previous quarter, and at nearly 9 million square meters reached the highest point since Q2 2022. The global vacancy rate rose another 25bps in the fourth quarter to a new high of 16.2%, with the largest increase recorded in North America, followed by Europe and Asia Pacific.

Rising activity in emerging living markets

Global housing markets continue to see a rise in renting and

a fall in home purchasing against a backdrop of constrained affordability.

Pressures are mounting in many rental markets, with housing supply falling and

demand growing. Long-term structural trends including aging populations, demand

for education, and limited housing availability continue to underpin investor

conviction for living investment strategies.

Despite challenged capital markets, living investment reached its highest share of total real estate investment on record in EMEA and Asia Pacific during 2023. In the Americas, however, living volumes declined sharply with the multifamily sector facing short-term supply pressures; nonetheless, activity is expected to rebound to pre-pandemic levels over the next 12-18 months. Living alternatives such as single-family rental (SFR), student housing and co-living continued to generate interest globally as investors focus on diversifying income.

Urban hotel performance accelerating

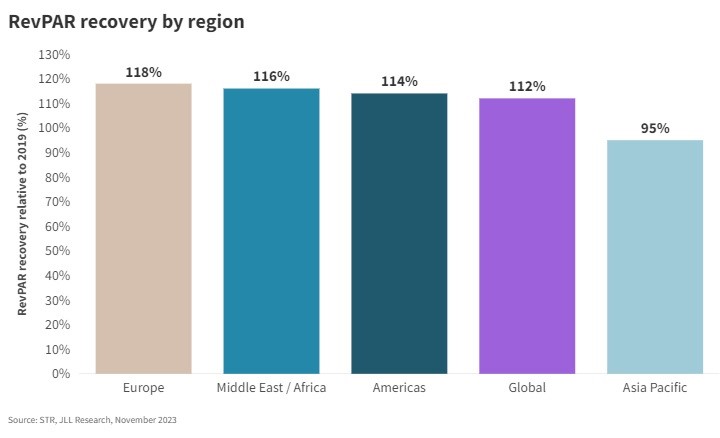

While global hotel revenue per available room (RevPAR) remains elevated, surpassing 2019 levels by 11.7% through the first eleven months of 2023, performance has begun to normalize as some leisure travel contracts. Stabilization has weighed heaviest in resort markets, predominantly in the Americas and EMEA, with Asia Pacific continuing to accelerate as intraregional travel grows following border reopenings. Global urban market performance is strengthening, propelled by a surge in international travel and the return of business and group demand. Markets like London, New York and Tokyo are expected to lead global RevPAR performance in 2024 as travelers continue to return to cities.

Following the removal of all post-pandemic restrictions, global international travel surged in 2023, reaching 87% of 2019 levels. The effect on urban hotel demand cannot be understated as historically there has been a 90% correlation between inbound foreign arrivals and urban hotel occupancy, with the greatest impact in gateway markets such as London, New York and Tokyo. As we head into 2024, we expect international travel to accelerate further, with Europe likely the largest beneficiary as it prepares for the Summer Olympics in Paris and Taylor Swift takes her Eras Tour to the UK and Western Europe. This pickup in travel should also fuel global hotel liquidity. Foreign capital, which has been largely absent since the onset of Covid, is anticipated to be increasingly active over the next 12 months. Middle Eastern and Asian investors will likely be the most acquisitive, with urban markets in Europe and select U.S. cities the largest beneficiaries of capital.